Understanding the price of wine

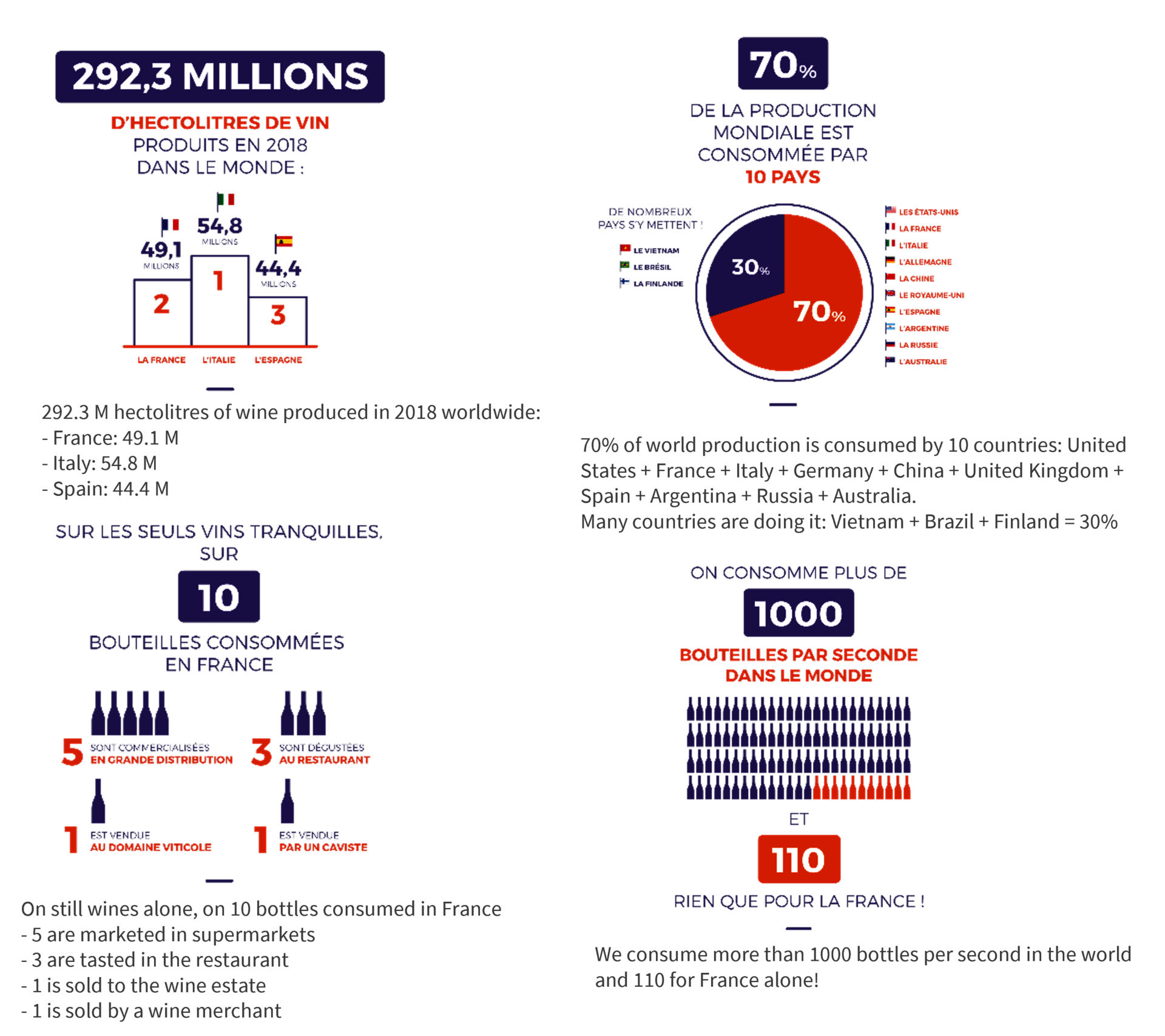

To fully understand what shapes the price of a bottle of wine, it is important to start with a global view of the market. According to the International Vine and Wine Organization (“Organisation Internationale de la Vigne et du Vin” - OIV), in 2020 the world produced about 34 billion bottles of wine. 53% of this production is concentrated in France, Spain and Italy, followed by the United States, Australia, New Zealand, South Africa and Chile for an additional 25%. With about 3 billion bottles consumed per year, France is one of the 10 countries that consume 70% of the world’s wine production each year, despite a per capita consumption divided by two for about 50 years. Finally, it should be noted that at world level, wine consumption accounts for only 8% of total alcohol consumption (2019).

The price of a bottle of wine is appreciated in two different ways: the price of the bottle at a given moment, when it is sold to the public for example, and the ability of this price to evolve over time. The vast majority of wines produced in the world will never see their initial price increase and, on the contrary, over time will see an almost continuous drop to zero.

Conversely, a small quantity of wines can be described as great vintage, or great wines or exceptional wines… For their part, they will see a continuous increase, sometimes very large, sometimes almost unlimited (for a handful of them). Among these some will see their prices stagnate after their exit although it is at high levels or increase before falling after a number of years.

So what determines the price of a wine and its evolution over time?

The exit price of a wine

This price, which will be the first posted and available for the public or for professionals (with a discount for the latter) will first be a function of:

The region and appellation where the wine is produced

Its ability of aging

The market for which it is intended (large distribution (5 bottles of 10), restaurateurs 3/10) wine merchants (1/10) particular (1/10))

The reputation and/or brand of the wine

The consumption trend (currently it is easier to sell a bottle of rosé than a bottle of soft wine for example)

All these elements will give a possible price range for each bottle. Then it is the winegrower who, as head of his or her business, will try to determine the most efficient price for his or her production.

The evolution of the price of wine over time

Most wines are therefore not intended to see their price increase over time. A large part of them simply do not have the vocation to «age» and therefore their tasting, which is limited in time to a few years, simply do not leave them the possibility of seeing their price appreciated. Others will have the ability to age several years, enough for their prices to change and yet there is little or no chance that their price will increase over time. A wine may be required to gain value according to a few - necessary but not sufficient - rules, such as its aging ability or the quality of the terroir where it is produced for example.

Then various elements will allow a growth of the price over time:

Its rarity/ difficulty of access

The rarer a wine is - if the quantity produced is small for example - the more it can see its market value increase. But be careful: scarcity is not enough, it must be linked to a strong demand. The rarity is also found in the number of bottles remaining in circulation but also in the format - there is less magnum than bottle and less double magnum than magnum and so on. On the other hand, magnum is considered the best tasting format, so it remains the most sought after.

Some wines are also accessible only on allocation of the domain which strengthens the demand and can sometimes create an inflationary spiral of the price over time. This is especially the case for most great Burgundian wines where the quantities produced are not enough to meet the demand.

The brand or name of the Château

Some great wines of Bordeaux or Burgundy, in particular, see year after year a favorable evolution of the prices of their wines as well as of its evolution over time. This is the case of the big names from Bordeaux, such as Margaux, Mouton and Lafitte Rothschild or the few large Burgundy winemakers like Leroy or Rousseau and many others.

The note

Some regions or certain wines are awarded a rating every year by a panel of tasters. These notes can be of considerable importance. That’s why, for example, a 1989 High Brion bottle costs around €1,800 while all the other wines on the estate are worth between €400 and €600 on average. In 1989, the first wine from Haut Brion was rated 100/100 by Robert Parker (the famous American wine taster).

Fashion

There are sometimes fashion effects that will have an impact on the price, a fashion on a winegrower or on a appellation, or on a particular wine.

And what about the quality?

Of course the few wines that are part of this very limited club are always perfectly made wines. However, fortunately, many winemakers make exceptional wines for each vintage, but for the reasons mentioned in this article, their price will not necessarily increase over time. On the other hand, the wine will evolve and can reach a perfect tasting maturity.

Thus, we must not confuse the variable price of a bottle of wine with the pleasure of tasting it. Is a bottle worth €5,000 five times better than a bottle worth €1,000 and 50 times better than a bottle worth €100?

In recent years, with the emergence of developed countries, great wines have moved from the stage of consumer products to the stage of luxury products, allowing the emergence of a new market and the creation of what might be called «ultra great vintage». This translates into the price of some bottles that count in thousands of euros or even tens of thousands of euros.

Faced with a complex market, an expert can help you better understand its ins and outs. We invited you to contact your Private Banker to learn more about our Wine Banking solutions.

Would you like to discuss this subject further with us?

This document, of an advertising nature, has no contractual value. Its content is not intended to provide an investment service, it does not constitute investment advice or a personalised recommendation on a financial product, or a personalised advice or recommendation on insurance, or a solicitation of any kind, legal, accounting or tax advice from Société Générale Private Banking France.

The information contained is for information purposes only, may be modified without prior notice, and is intended to communicate information that may be useful for decision-making. Any information on past performance reproduced does not guarantee future performance.

Before any investment service, financial product or insurance product is subscribed, the potential investor (i) must be aware of all the information contained in the detailed documentation of the proposed service or product (prospectus, regulations, articles of association, document entitled “key information for the investor”, Term sheet, information notice, contractual conditions, etc.), in particular those related to the associated risks; and (ii) consult its legal and tax advice to assess the legal consequences and the tax treatment of the product or service envisaged. His private banker is also at his disposal to provide him with further information, to determine with him whether he is eligible for the envisaged product or service which may be subject to conditions, and whether he meets his needs. Consequently, Societe Generale Private Banking France cannot be held responsible under any circumstances for any decision taken by an investor based solely on the information contained in this document.

Future performance forecasts are based on assumptions that may not materialize. The scenarios presented are estimates of future performance, based on past information on how the value of an investment varies and/or on current market conditions, and are not accurate indications. The return obtained by investors will have to vary according to the market performance and the duration of the investment’s retention by the investor. Future performance may be subject to tax, which depends on the personal situation of each investor and is likely to change in the future.

For a more complete definition and description of risks, please refer to the product prospectus or, where applicable, to other regulatory documents (if applicable) prior to any investment decision.

This document is confidential, intended exclusively for the person to whom it is given, and may not be communicated or disclosed to third parties, or reproduced in whole or in part, without the prior written consent of Société Générale Private Banking France. For more information, click here.