The timber industry and MyTree

A tree planted every 10,000 euros subscribed! This is Societe Generale Private Banking's (SGPB) new positive and sustainable structured products programme, which is in addition to the charity programme and the positive impact finance programme.

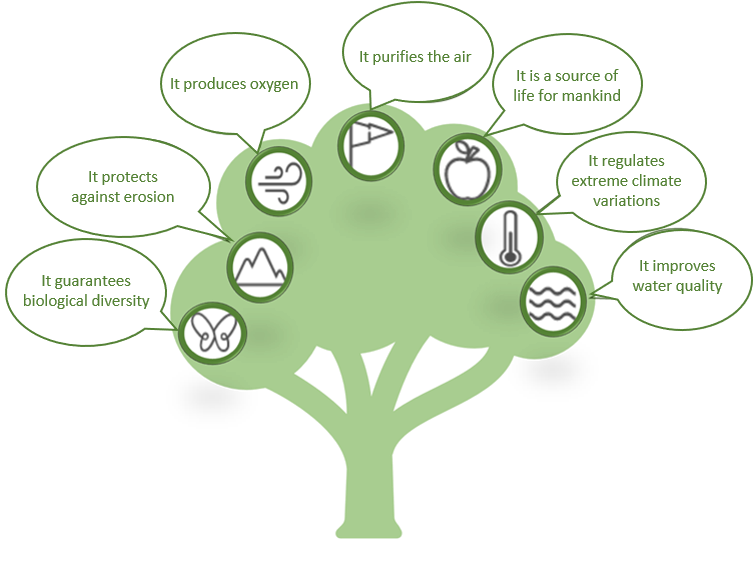

How does it work and why trees? When subscribing to a dedicated structured product, Societe Generale Private Banking's investor clients are offered the opportunity to include their product in the "Let's Plant a Tree" programme. At no additional cost to them, and for every 10,000 euros of subscription, Societe Generale Private Banking finances the purchase of a tree. We have chosen the MyTree start-up as our partner, a small company the aim of which is to generate social and environmental benefits. MyTree puts online tree planting projects, generally led by NGOs or forestry organisations, rigorously selected and mostly located in France. For this first collaboration, with the help of MyTree, we have selected two programs carried by the ONF ("Office National des Forêts - National Forestry Office) aiming at restoring two damaged state forests, one in Montmorency in the Paris region and the other in Secondigny (Deux Sèvres department). The trees, including oaks, will be planted at the end of Autumn and in Winter 2020, the most propitious season. This programme is an opportunity to look back on all the benefits that trees offer us, especially in terms of the environment.

During their growth and through photosynthesis, trees capture CO2 from the atmosphere and produce oxygen. By sequestering annually between 20% and 30% of global carbon emissions, forest ecosystems are true carbon sinks. Forests therefore play a central role in climate regulation and are, in fact, a major element in the fight against global warming. It is generally estimated that a tree absorbs between 10 kg and 40 kg of CO2 per year depending on the species and longevity of the tree, and also on the nature of the soil. An estimate included in the United Nations Framework Convention on Climate Change (UNFCCC) sets the absorption capacity of a tree at 10 kg of CO2 per year. It will take eighteen trees to absorb the emissions of a single Paris/Marseille car journey over one year.

It is therefore up to us to take care of these natural carbon sinks that are forests and this is the contribution that SGPB wanted to make with the "Let's Plant a Tree" programme. Because if they are not properly maintained and exploited, forests can be sources of greenhouse gas emissions in their turn. Trees are fragile and like all living things... they die one day. Its decomposition in the soil then releases CO2 into the air. Moreover, forests (particularly through the degradation of fallen leaves and under certain conditions) are potential sources of methane, a gas with a global warming potential nearly thirty times greater than CO2.

Exploiting wood and reusing it rather than letting it decompose enables the CO2 stored during the growth of trees to be conserved. For example, wood can be chosen for construction or landscaping products, which has the advantage of being more energy efficient than other materials: at the time of its manufacture and in terms of thermal insulation performance, wood is fifteen times more efficient than concrete. Saving energy means reducing CO2 emissions even further. Moreover, at the end of its life, construction wood can be recycled once again or reused as an energy source (to power boilers, for example). In this context, saying yes to wood means saying no to CO2 to combat the greenhouse effect every day!