Esport: Game on

Lagos, 16 February 2025, Nigerian Ngozi Malamu, better known by her professional name Okpuruishi, is ecstatic. “To all the girls who want to do competition-level esport, I say Yes you can!”

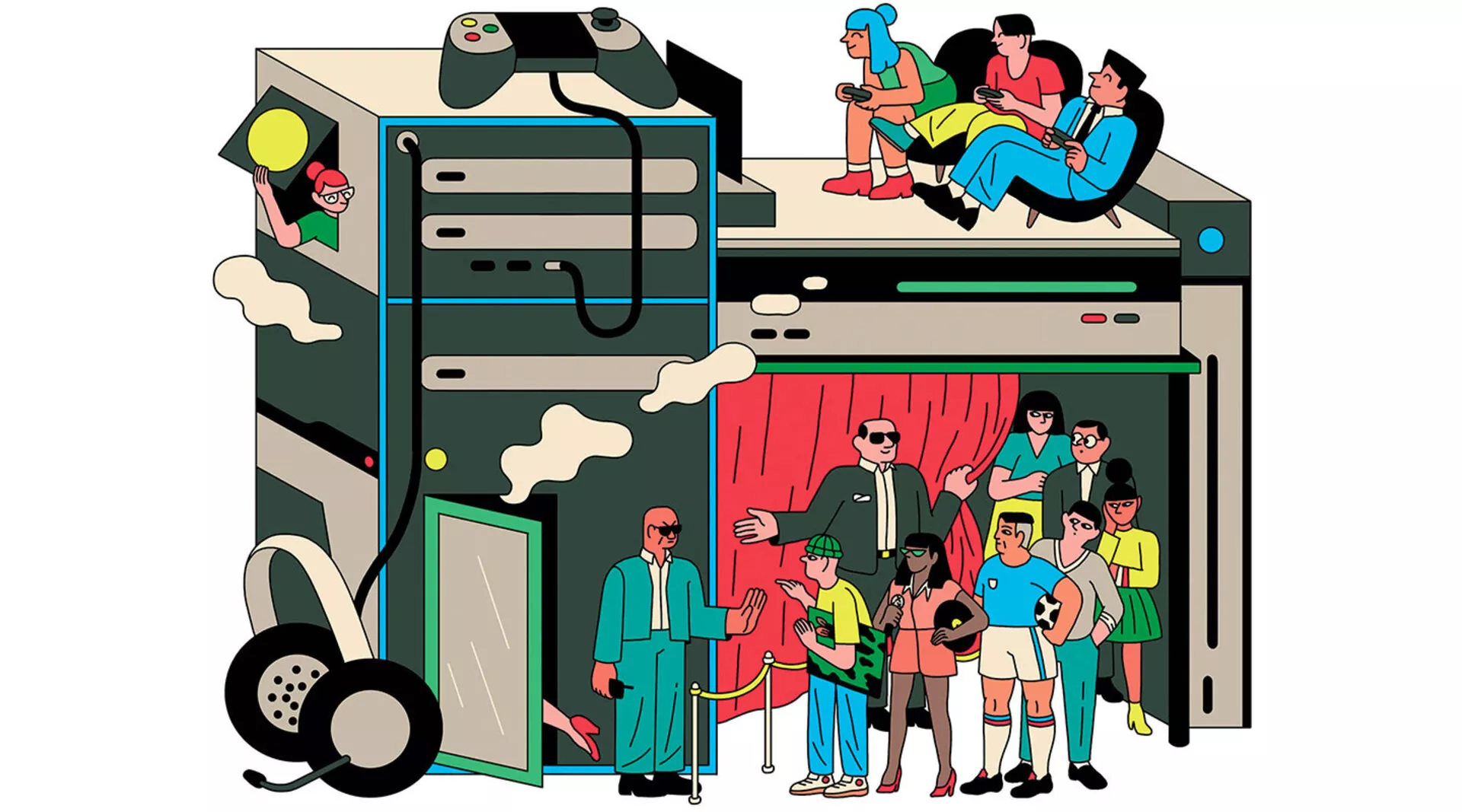

Leading the world championships in League of Legends: Wild Rift, the cult video game specially designed for mobiles, she has become the first African champion in the history of esport... So why shouldn’t this fantasy become reality when we consider that Africa has more than 600 million users of smartphones and tablets? From Kigali to Dakar via Casablanca, young people are training and competitions are being organised. The impressive potential for growth in esport across the continent is a sure sign of the current trend: “Playing a video game in competition on the Internet, alone or in a team, through a computer, a console, a tablet(1)” or a smartphone is becoming a global phenomenon.

Esport has exploded over the past decade, with an audience of 495 million viewers and revenues of $1 billion worldwide in 2020(2), equal to the size of the entire global market for tennis. Over the years, the number of competitions has multiplied and championships have been established and keenly followed all over the planet. Players – the Chinese VKLiooon, the French Kayane, the Korean Faker, the American Bugha, etc. – are elevated to the rank of superstars by the fans. And the expansion possibilities for esport are immense when compared to the entire sports market ($700 billion) and especially if it is considered as part of the video game industry ecosystem, where turnover has increased to $159 billion in 2020, surpassing that of the film and music industries combined.

The figures are astonishing: China, the world leader, has the largest audience with 162.6 million viewers, followed by North America with 57.2 million viewers. Europe is not so far behind with 37 million spectators (2017 figures) and $201.2 million in revenue generated, against $385.1 million for China and $252.8 million for North America.

Diversified investors

While esport first took off with the arrival of the Internet in the 1990s, several factors explain its explosive growth from 2010 onwards. “The major developers have released new games designed to be competitive, that means, to be followed and watched by an audience, and in parallel the streaming platforms (Twitch, YouTube, Dailymotion, etc.) have greatly expanded, making esport accessible to everyone across the world, explains Nicolas Besombes, professor at the University of Paris and vice-president of the France Esports association. “Developers have changed their economic models by launching free-to-play online games, thus accentuating the media coverage and popularisation of esport.”

Sociologist Samuel Coavoux believes that the turning point was the release, in 2009, of League of Legends (LoL), a free downloadable game that attracts a large number of players and spectators alike. Ten years later, now the world’s largest esport event, the final of League of Legends with 15,000 people gathered at the AccorHotels Arena in Paris, and a peak of 44 million simultaneous spectators, gives the measure of the scale of the phenomenon.

The very rapid growth of esport has encouraged the massive inflow of investment capital which has further enabled its continued development.

Takeover of the streaming platform Twitch by Amazon in 2014, the exclusivity contract between the YouTube Gaming mobile application and American video game publisher Activision Blizzard, the partnership of Chinese Alibaba with the International Esport Federationvia its subsidiary Alisport..., examples are multiplying. All illustrate the rapid evolution of the sector in which historical investors linked to electronics and telecoms (HP, Dell, Intel, Microsoft, Numéricable, Orange, etc.) are no longer the only ones taking a keen interest.

They are now joined by large companies in the food, automobile, luxury goods, sports equipment and financial sectors, together with sports bodies, in particular football clubs (PSG in France, Schalke 04 in Germany, Ajax Amsterdam in the Netherlands and Manchester United in the UK), and even individual stars like Michael Jordan or Will Smith. The level of investment in esport totalled $4.5 billion in 2018, according to the audit company Deloitte.

Esport... did you say sport?

The International Olympic Committee (IOC) has stated that “competitive electronic sports could be considered a sporting activity”. In fact, professional esport players must undergo intensive training, up to eight hours a day on a game, acquire a particular technical skill and adhere to a lifestyle worthy of that of professional sportsmen.

They share common values: surpassing oneself, sportsmanship integrating fair play, competition and pleasure. A demonstration sport at the Asian Games, in Indonesia in 2018, will esport one day become an Olympic discipline? At the end of 2018, the IOC deemed its integration premature. “This is where the major difference lies with sport, the basis of this sporting activity, the game itself, belongs to a private company, the video game publisher, which is protected by intellectual property rights. The practice is therefore framed by copyright (…).

The development of competitive circuits, events or even amateur practices cannot be done without the agreement of the video game developer”, explains Maxime Rocheux, project manager at Caisse des Dépôts*. “Unlike in traditional sports, where the evolution of rules is slow, and is done by consensus within the federations, game publishers have all the power to modify their product and the rules of the competition”, adds the sociologist Samuel Coavoux**.

As a result, esport today remains a compartmentalised universe where each game, publisher or sponsor develops its own business and its own competition. Will the players in this ecosystem seek to build global governance to harmonise competitions? Esport is only at the beginning of its journey...

* See the article “Esport and territories, a winning equation?”, on www.caissedesdepots.fr, 13 July 2020.

** See “Video games, sociology of mass leisure”, on www.laviedesidees.fr, 12 November 2019.

At the crossroads of several domains

This area, at the frontiers of sport and new technologies (5G, artificial intelligence,cloud computing, etc.), symbolises the cultural codes of the global youth market. “Esport is at the crossroads of several fields, video and sport primarily, but also music, fashion and technology. This explosive cocktail attracts the large majority of young people and has an immense influence”, underlines Pierre Acuña, head ofgaming and esport at Havas Sports & Entertainment(3). “Esport fans adopt all codes, and the teams borrow a little from football, from music or from manga to forge their own identity (…) video games are becoming a quintessential expression of creativity.” On this there is no doubt for Sylvain Granados, online player and author of a book on the subject(4), that with the development of virtual reality and other technologies, esport will have an impact on society similar to that of traditional sports(5).

South Korea is the most successful example, where video games are part of popular culture and where some players have a larger fan base than singers or actors. Esport has been recognised as a genuine sport there since 2000 and many teams around the world are calling on Korean gaming talent. Even if this country is still an exception, “it is time to look at video games as a normal cultural object, with both their good and bad sides”, estimates journalist Antoine Tricot, who has devoted a documentary series to this subject on France Culture. The interpenetration is actually growing between video games and other cultural practices and it now influences a range of artistic genres, such as cinema, literature and even music.

Pandemic and resilience

Is Covid-19 slowing down these exciting developments? Nicolas Besombes underlines the paradox of the current situation: “For the first time in its history, esport could experience stagnation, or even regression because its economy is precarious insofar as it largely depends on sponsors and private investors who are forced, in times of crisis, to make financial trade-offs that are not necessarily favourable to the sector.

But, on the other hand, its digital dimension has saved esport. While traditional sports were brought to a halt, esport carried on and exclusively online competitions could still take place, reaching audience records. “This resilience has changed the perception of esport among brands, with sponsorship departments now fully understanding that it can be a formidable marketing tool, according to Alban Dechelotte, head of partnerships and development at Riot Games(6), the American video game developer.

A cultural practice without borders

In Africa, where esport is now also emerging, its players have seen its powerful role as a cultural vector. For Ife Akintaju, the founder of the news siteThe AfroGamer(7), it represents the opportunity to “link our culture to games (…) to tell our stories.” African game developers such as the Kenyan Ludique Works or the Cameroonian Kiro’o Games, highlight African mythology, fashion and music. Beyond the creation of cultural content, this sector can promise new opportunities for African youth. “It will be about making key decision-makers understand that it’s not just a matter of controllers and competitions.

There are social aspects, linked to education, training and business”, affirmed Serge Thiam, specialist ingaming, during the Pan-African Orange Esport Experience tournament, in December 2019 in Tunis. A mine of opportunities, therefore, for skills and jobs in the fields of tech and digital. Peace and Sport, an international organisation that promotes peace through sport, has just joined theGlobal Esports Federation, based in Singapore, in order to promote, among other things, education and training initiatives through esport. This ability of esport to symbolise the culture of young people, creativity and to transcend borders, appeals to a number of economic players. It allows them to target millennials, who are increasingly closed to traditional media. “Generations Y, Z and even Alpha have shaken up traditional advertising codes”, says Mike Hessabi, co-founder of the game platform Nicecactus(8), “Branding advertising and sponsorship strategies need to be completely overhauled.”

Everyone has their own rules

A new discipline undergoing constant evolution, esport is a complex ecosystem in which many different actors maintain commercial, influence and partnership relationships(9) and which operates largely on a principle of self-regulation. Each competition, each game, each league and each organisation sets its own rules. “The software houses set the rules of their own games”, specifies Stéphane Rappeneau, “and the biggest of them run highly structured ecosystems, by organising international tournaments and setting precise rules for the teams, with standards comparable to those existing in traditional sport.” And as with those traditional sports, esport is itself not immune to issues of integrity and the need to respect ethics. “Cash prizes are the key point of competitions, often reaching several million dollars (…), so the personal interests of players or intervention by illegal bookmakers can have an impact on the integrity of this new discipline”, note the consultants Étienne Adam and Maëlle Thiébaut in a study, noting that the main risks are cheating, doping and match-fixing. The betting market, estimated at $13 billion in 2020(10), has developed a lot in this sector and the appearance of“loot boxes” and “skins”(11) is fertile ground for speculative practices.

“Integrity issues are important and there is a real awareness among esport actors”, insists Nicolas Besombes. “At the international level, an independent body, theEsports Integrity Commission (ESIC) works to prevent and fight against corruption.” The ESIC makes players aware of the problems of cheating, illegal betting and has set up anti-doping checks(12) during major tournaments. Some countries already have public structures and legislation in place for the regulation of esport. Korea has laws that criminalise attacks on the integrity of esports. Sweden, Spain, the UK, Italy and the USA regulate betting. In France, esport is regulated by the “Law for a Digital Republic” of 2016 and by two decrees of 2017 on the status of professional players and the organisation of esport events.

Societe Generale gets into the game

Continuously committed to rugby and disabled sports, Societe Generale has been extending its sponsorship activities to esport since 2018, to engage with a younger and changeable audience. A major sponsor of the GamersOrigins esport club, one of the top three French teams, the bank has supported the club in its first fundraising in 2019. With a League of Legends bank card collection launched on the occasion of Worlds 2019, a talent scout tournament and an internal tournament of the game Fortnite, Societe Generale intends to become the benchmark sponsorship player in the world of gaming. “Esport helps to anchor our brand in the spirit of the times, to highlight our culture of innovation among the millennial generation”, underlines Stéphane Rappeneau, financial engineer and video game expert at Societe Generale.

Esports fans adopt all codes, the teams borrow a little from football, from music or from manga to forge their own identity (...) video games are becoming a quintessential expression of creativity.

Go girls!

Among the other challenges of esport, the promotion of female participation is a major priority. While mixed in principle, esport in reality leaves little room for women, including on the professional scene: according to the France Esports 2020 barometer, although women represent 53% of “mainstream” players, in France,

only 6% participate in competitions. Added to this is the issue of sexism, which leads female players

to conceal their identity or even abandon gaming altogether. “I spoke very little because I didn’t want anyone to know that I was a woman”, says Laura Déjou, Fortnite team coach for the MCES club.

Servane Fischer, former high level Counter-Strike player and member of the association Women in Games France(13), nonetheless notes a positive development: “These subjects are now on the table, men are getting involved alongside women, structures like brands want to highlight diversity in order to adhere to corporate inclusivity values”. Despite these changes though, it will take time to redress the balance.

Objective: changing mentalities

This observation led the associationWomen in Games France to create an incubator for female players where they can benefit from technical coaching to progress in competition. “We must encourage skills and mixed tournaments”, insists Servane Fischer, “by working in concert with esport stakeholders, such as software developers, so that they create games with more diverse characters, and also with the organisers of events, so that they undertake more inclusive communication strategies, and highlight women who work within this sector. A lot of awareness-raising work needs to be done with parents and in schools to secure practices connected with video gaming but also to show that gaming provides both girls and boys with training and employment opportunities.” Promoting ethical and inclusive esport certainly involves education in relationships right from an early age.

- 1 Definition of esport according to the France Esports association, www.france-esports.org.

- 2 According to Global Esports Market Report 2020 from Newzoo, analyst of the video games world.

- 3 L’Équipe, 22 September 2020.

- 4 Introduction to esport - The Next Big Thing, by Sylvain “SydHoon” Granados, 2017 (e-book).

- 5 Economic cafes of Bercy, 28 April 2017. www.cafes-economique.fr.

- 6 Interview in Sport Strategies, 7-13 July 2020.

- 7 www.theafrogamer.com.

- 8 Interview in Sport Strategies, 7-13 July 2020.

- 9 As Étienne Adam and Maëlle Thiebaut, consultants at CEIS, explain in a study note “Esport: what are the new challenges for compliance?”, September 2019.

- 10 According to a study co-authored by Narus (software developer) and the firm Eilers & Krejcik.

- 11 A “loot box” is a kind of virtual “lucky bag” where the player does not know the contents before buying it. “Skins” are virtual objects (for example, a character’s costume). “Loot boxes” and “skins” represent significant sources of income for video game publishers.

- 12 In the esport sector, doping consists of taking medicinal substances intended to increase concentration and/or reaction times. A drug, Adderall, with effects comparable to amphetamine, has made a name for itself in the community.

- 13 womeningamesfrance.org.

Key dates and figures of esport

1972. Organisation of“The Intergalactic Spacewar”, the first esports tournament at Stanford University.

1997. Birth of the first esports leagues: the Cyberathlete Professional League (CPL), the AMD Professional Gamers League (PGL), in the United States, and the Electronic Sports League (ESL), in Germany.

2019. Organization of the Fortnite Worldcup, with over $30 million in gambling winnings.

$1.1 billion global revenue in 2020.

495 million Internet users around the world are interested in esport.

222.9 million watched it at least once a month in 2020.

105.5 million hours of viewing for the game League of Legends on the Twitch and YouTube platforms (2019 figure).

The Top 3 Most Popular Online Games in 2020

League of Legends (LoL). Strategy game in which two teams of five “champions” compete to destroy the opponent’s base. Created by Riot Games.

DOTA 2. Same universe inspired byheroic fantasy, same mechanics and character styles as LoL, but with different options. Created by Valve Corporation.

Fortnite. In Battle Royale mode, 100 players compete on an island to be the sole survivor. Created by Epic Games.