Brexit and the French tax regime for capital gains

On 1 February 2020, the United Kingdom officially left the European Union. It had nevertheless maintained its member state status up until and including 31 December 2020, when the transition period ended. Before then, on 24 December 2020, the EU and the UK signed a trade agreement and partnership. The agreement includes very few tax provisions, setting out only the tax governance framework agreed to by member states for fighting tax fraud and evasion, and for sharing information. France has numerous special tax schemes for individuals or companies based in a country that is part of the EU or the European Economic Area (EEA), and so the UK’s loss of its member state status on 1 January 2021 has a number of implications.

1 January 2021

As of this date, the UK is recognised as a third country and is no longer subject to European law – and in our case, tax law. Still applicable, however, is the UK/France tax convention(1), supplemented by the multilateral instrument, for the avoidance of double taxation on income and on capital gains. Brexit has made this bilateral treaty a veritable safety net for residents in both countries. In this article we take a look at what impact Brexit has on the taxation of the capital gains of executives who are tax residents in France, but whose companies are held through a UK-based company or intermediary.

note: In accordance with the convention signed between France and the UK for the avoidance of double taxation with respect to taxes on income, capital gains derived from the disposal of shares in a UK company by a French taxpayer are only taxable in France(2).

Executives who are tax residents in France

>> Capital-gains

Since 1 January 2018, capital gains derived from the disposal of shares are automatically taxed at a flat tax rate (Prélèvement forfaitaire unique – PFU) of 30%.

IN SHORT

30% flat tax comprising

12.8% for income tax

17.2% for social levies

And possibly an exceptional contribution on high income (Contribution Exceptionnelle sur les Hauts Revenus - CEHR) at a rate of 3% and/or 4% depending on the taxpayer’s actual taxable income-

Less a fixed allowance of €500,000 for retiring executives (for the calculation of income tax only) - Conditions set out in article150-0 D ter of the French tax code.

There is also the option of taxing all capital gains at the progressive income tax rate.

The choice of tax regime will depend on the taxpayer’s personal circumstances, i.e., their marginal tax bracket, as well as their objectives, and may require the services of a tax expert to do a preliminary assessment. For example, above the 11% tax bracket (new bracket for 2020 income), the progressive tax rate is less attractive than the 12.8% flat tax. However, a threshold comes into effect when deducting the fixed allowance of €500,000. Under the progressive income tax option, and subject to conditions, proportional allowances (standard or increased) linked to the holding period are applicable to capital gains derived from the disposal of shares, as is the fixed allowance of €500,000 (for the calculation of income tax only). It is also necessary to make a distinction between shares acquired before and after 1 January 2018.

IN SHORT

=> Disposal of shares acquired BEFORE 1 January 2018

Progressive income tax rate

Less a standard allowance linked to the holding period

OR less an increased allowance linked to the holding period (for SMEs less than 10 years old) - Conditions set out in Article 150-0 D, 1 quater B of the French tax code

OR Less a fixed allowance of €500,000 for retiring executives(3) - Conditions set out in Article 150-0 D 1 ter of the French tax code

=> Disposed shares, acquired AFTER 1 January 2018

Progressive income tax rate

Less a fixed allowance of €500,000, for retiring executives - Conditions set out in Article 150-0 D, 1 ter of the French tax code

Post-Brexit impact: To benefit from the increased allowance (for SMEs less than 10 years old) or the fixed allowance (€500,000), certain conditions must be met. The company of the disposed shares must have its headquarters an EU country or in a country that is part of the EEA and must have concluded an agreement with France containing an administrative assistance clause to fight fraud and tax evasion. The UK’s withdrawal from the EU means losing both the increased (for SMEs less than 10 years old) and fixed (€500,000) allowances that used to apply to the disposal of shares in companies having their headquarters in the UK.

>> Tax deferreal

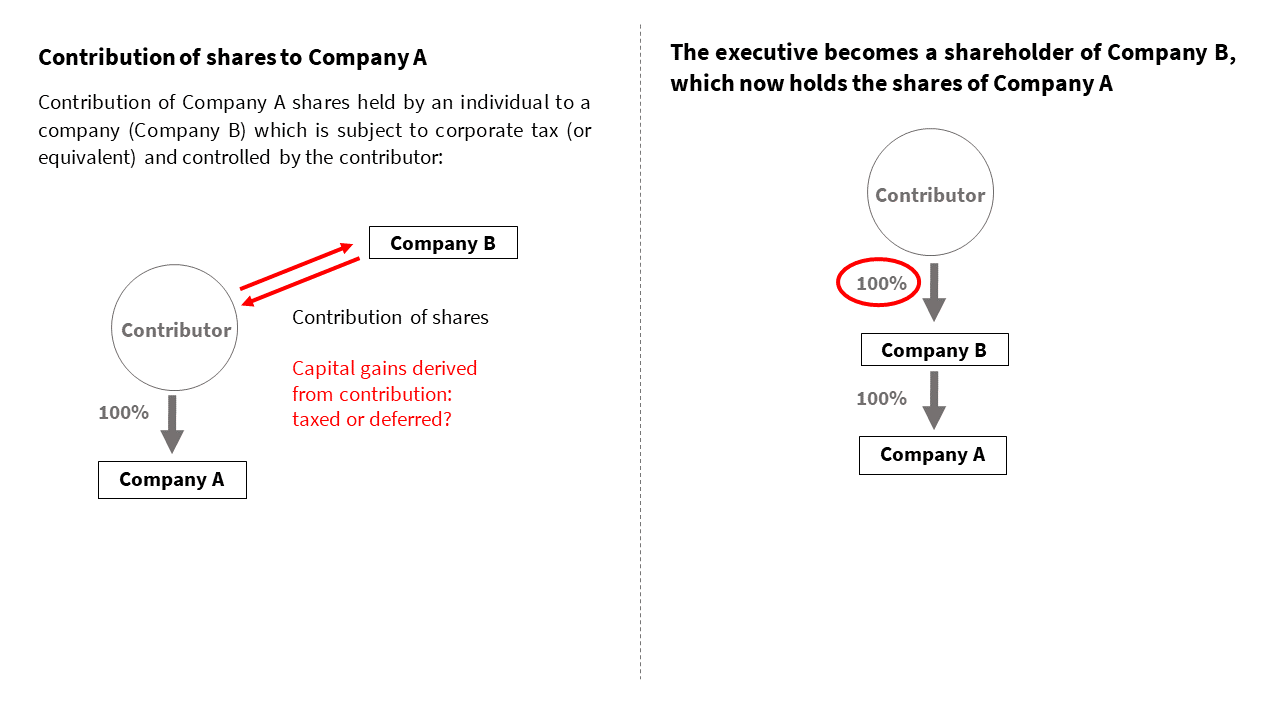

Another attractive tax provision for executives in France is the deferred taxation of capital gains derived from the contribution of shares to a company they control (Art. 150-0 B ter of the French tax code)(4).

TAXATION DEFERRAL MECHANISM

The capital gain derived from the share contribution must be calculated and filed in the year following the year of contribution. The taxation of the contribution is therefore deferred until the occurrence of the events set out in Article 150-0 B ter of the French tax code.

Post-Brexit tax impact: Subject to further conditions, the tax deferral regime is applicable to the contribution of shares to a company with share capital, or of similar status, that is subject to corporate tax (or equivalent) and is established in France or in another EU country or in a country part of the EEA that has concluded an agreement with France containing an administrative assistance clause to fight fraud and tax evasion(5). The tax convention concluded between France and the UK for the avoidance of double taxation with respect to taxes on income can be considered as an agreement containing such an administrative assistance clause, provided that the UK continues to assist France without restriction. This so far looks to be the case, as the EU and the UK have committed to continue sharing information with one another. Therefore, French tax residents may continue to benefit from the tax deferral regime, all conditions having been met, for the contribution of shares to a UK company that is subject to corporate tax (or equivalent) and is controlled by the contributor.

EVENTS TERMINATING TAX DEFERRAL

The deferred capital gain is taxed based on the year of the occurrence of certain events occur that result in the termination of deferral. These include disposal in exchange for a fee, buyout, redemption or cancellation of the contributed shares by company B within three years of the date of contribution. However, these events do not terminate the tax deferral if company B undertakes to reuse, within two years of the disposal, at least 60% of the proceeds to reinvest in the economy according to the terms of Article 150-0 B ter of the French tax code.

Post Brexit tax impact : Said proceeds can be reinvested in a company that meets specific conditions that include having its headquarters an EU or EEA country that concluded an agreement with France containing an administrative assistance clause to fight fraud and tax evasion. In light of these conditions, companies having their headquarters in the UK are not eligible for the reinvestment of 60% of proceeds.

TAX REGIME APPLICABLE TO DEFERRED CAPITAL GAINS

Upon the expiry of the tax deferral, t capital gain, determined on the day of contribution, is taxed according to the taxation rules in force in the year of the contribution, and not in the year in which the deferral expires. Therefore, if the shares received in exchange for the contribution are disposed of, two capital gains may be recorded and taxed differently: deferred capital gain (tax-base rules in force on the day of contribution); and the capital gain from the disposal of Company B shares corresponding to the capital gain realised (tax-base rules in force on the day of disposal). But if the share contribution falls under EU law in the form of the Merger Directive(6), the corresponding capital gain may be determined and taxed according to the rules in force on the day of the shares’ disposal (and not on the day of contribution)(7). France’s tax treatment of capital gains from share contributions depends on whether these transactions fall within the scope of the Merger Directive.

Post Brexit tax impact : The Merger Directive applies to transactions, including share contributions, involving companies established in EU member states. Since the coming into effect of Brexit, share contribution transactions involving a UK company therefore no longer fall within the scope of the Merger Directive. Therefore, the capital gains derived from the contribution of shares to a UK company will be determined and taxed according to the tax rules in force on the day of the share contribution.

IN SHORT

Tax deferral provision (Article 150-0 B ter of the French tax code)

The tax deferral regime is applicable where shares are contributed to a company with share capital, or of similar status, subject to corporate tax (or equivalent) and established in France or in another EU country or in a country part of the EEA that has concluded an agreement with France containing an administrative assistance clause to fight fraud and tax evasion.

Post Brexit tax impact: None. The UK signed such a convention with France.

Events terminating tax deferral

The reinvestment of 60% of proceeds to ensure ongoing tax deferral can be made, all conditions having been met, in a company having its headquarters in an EU country or in a country part of the EEA that has concluded an agreement with France containing an administrative assistance clause to fight fraud and tax evasion.

Post Brexit tax impact: Said proceeds may not be reinvested in a UK company.

Tax regime applicable to deferred capital gains

Should a share contribution fall within the scope of the EU Merger Directive, the corresponding capital gain may be determined and taxed using the rules in force on the day of disposal (and not on the day of contribution).

Post-Brexit ax impact: The capital gain derived from the contribution of shares to a UK company will be determined and taxed according to the rules in force on the day of the contribution, and no longer on the day of the disposal.

Conclusion

From a wealth engineering perspective, particularly with regards to corporate restructuring and other operations, Brexit clearly has tax impacts. However, it is important to note that Brexit has no tax impacts in Switzerland and Monaco on account of their third-country status. EU Regulation no. 650/2012 on succession and on the creation of a European Certificate of Succession that determines jurisdiction and applicable law did not apply to the UK. SGPB Europe’s wealth engineering teams, legal and tax experts are at your service, alongside your dedicated wealth advisor, to help you draw up your wealth plans.

(1) Convention of 19 June 2009 with respect to tax on income and on capital gains

(2) However, the UK is still within its right to tax capital income if the taxpayer was at some point a UK tax resident in the six years prior to the disposal. In such case, the taxpayer can claim a tax credit equal to the amount payable in France against their UK tax. This topic will not be elaborated on further in this article.

(3) Code Général des Impôts - French tax code

(4) Annual option applicable to all PFU-eligible income and capital gains for the year.

(5) Allowances (standard or increased) linked to the holding period and the fixed allowance of €500,000 are non-cumulative.

(6) This tax deferral regime is automatically applied (subject to certain conditions) to contributions of shares as of 14 November 2012 to a company controlled by the contributor.

(7) French administrative guidelines BOI-RPPM-PVBMI-30-10-60-10 no. 20

(8) 2009/133/EC of 19 October 2009

(9) This difference in treatment is the result of the CJEU judgement of 18 September 2019 (Joined Cases C‑662/18 and C‑672/18) which declared the rules for determining and taxing capital gains as incompatible with the principle of neutrality set out in Article 8 of the EU Merger Directive.

Would you like to discuss this subject further with us?

The content provided on this page is for information purposes only and is not contractually binding. It is not intended to provide an investment service, does not constitute investment advice, nor a personal recommendation in insurance, nor any form of canvassing, nor legal, tax or accounting advice from Societe Generale Private Banking.

Any and all information contained herein may be amended without prior notice, and is for illustrative purposes only to provide the reader with information that may be of use in making decisions. Information provided on past performance, even repeated performance, is in no way a guarantee of future performance.

Before subscribing to any investment service, financial product or insurance product, potential investors must (i) read all the information contained in the detailed documentation on the service or product under consideration (prospectus, regulations, "Key Investor Information Document", term sheet, contractual terms of the investment service, etc.), paying particular attention to the associated risks; and (ii) consult with their legal and tax experts to assess the legal and fiscal implications of the product or service under consideration. Investors may obtain more exhaustive information from their private banker who can also assist them in determining their eligibility to the product or service under consideration, which may be subject to conditions, and whether such product or service meets their needs. Societe Generale Private Banking shall under no circumstances be held liable for any decision made by an investor on the basis of this information alone.

This document is confidential and intended solely for the recipient; it may not be made public nor disclosed to any third party, and may not be reproduced in whole or in part without the prior written agreement of Societe Generale Private Banking. Click here for more information.