Understanding the SRI Label from the French Government (“Label ISR de l’Etat Français”)

SRI is an investment that aims to reconcile economic performance with social and environmental impact, by financing companies and public entities that contribute to sustainable development, regardless of their sector of activity(1).

The SRI label created in 2016 by the French Ministry of the Economy and Finance, aims to identify investment funds with measurable and concrete results, thanks to a proven socially responsible investment methodology. It is awarded at the end of a strict process conducted by an independent body, which is responsible for checking that the fund(2) complies with the label's specifications, the latest version of which, which is more demanding than the previous one, dates from 2020.

What are the conditions to get the label?

Obtaining the SRI label is subject to strict and rigorous specifications based on six requirements(3) :

- Defining the objectives sought: The candidate fund announces to investors and savers the objectives sought through the implementation of ESG (Environmental, Social and Governance) criteria. For example, it may be a question of projecting that a company that integrates sustainable development issues into its strategy will perform better in the medium and long term than another that does not make them a priority.

- Establishing an analysis methodology: It details the tools and means used to assess the ESG performance of assets prior to their acquisition.

- Building and managing the portfolio: The fund describes how it manages the various assets in its portfolio, based on extra-financial criteria. This may involve, for example, selecting companies with outstanding ESG performance in their sector.

- Engaging stakeholders: Management companies are encouraged to play an active role with companies through a voting policy at General Meetings and by raising awareness of the importance of ESG.

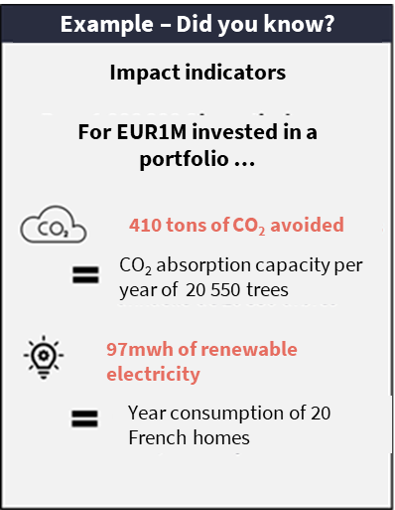

- Informing investors and savers: To ensure transparency, funds must report to investors on the achievement of their objectives, in particular by calculating measurable impact indicators.

- Evaluate the impact of the approach: In addition, the labelled funds are required to calculate and communicate their ESG score in relation to that of their benchmark index, as well as tangible indicators that show the real impact of their investments in terms of sustainability.

Why did we choose the SRI label?

Societe Generale Private Banking is committed to a more sustainable future by expanding the number of SRI-labelled investment solutions in its offering; for example, with the new generation of savings that seek to reconcile responsibility and performance, or within our dedicated management companies SG 29 Haussmann(5) and Societe Generale Gestion(6).

The SRI label from the French Government sets out a demanding and rigorous framework, enabling investors to invest with confidence in funds that focus on transparency. This certification, which is reviewed every year, enables us to help you make more responsible investments.

(1) According to the FIR: the French "Forum de l'Investissement Responsable" (Forum for Responsible Investment)

(2) Since 2020, alternative funds (in particular SCPI and OPCI (Frecnh equivalents of REITs) real estate funds) and institutional mandates are eligible for the SRI label.

(3) Source: SRI label website

(4) Source: DNCA

(5) Approved by the Autorité des Marchés Financiers in 2007, SG 29 Haussmann, a subsidiary of the Société Générale Group, is the portfolio management company dedicated to managing the assets of Société Générale Private Banking France's clients.

(6) Société Générale Gestion is the asset management company dedicated to the Société Générale network. It is a wholly-owned subsidiary of Amundi, the leading European asset manager. Societe Generale Gestion is a limited liability company with a share capital of EUR 90,285,567 034 094, whose registered office is located at 90, boulevard Pasteur, 75015 Paris. Société Générale Gestion, registered under number 491 910 691 in the Paris Trade and Companies Register, is approved as a portfolio management company by the AMF under number GP 009000020.

Would you like to discuss this subject further with us?

The present article, of an advertising nature, has no contractual value. Its content is not intended to provide an investment service, nor does it constitute investment advice or a personalised recommendation on a financial product, nor insurance advice or a personalised recommendation, nor a solicitation of any kind, nor legal, accounting or tax advice from Société Générale Private Banking France. The information contained herein is provided for information purposes only, is subject to change without notice, and is intended to provide information that may be useful in making a decision. Past performance information that may be reproduced is not a guarantee of future performance.

Before subscribing to an investment service, financial product or insurance product, the potential investor (i) must read all the information contained in the detailed documentation for the service or product in question (prospectus, regulations, articles of association, key investor information document, term sheet, information notice, contractual terms and conditions, etc.) and (ii) must be informed of the reasons for the decision. (ii) consult its legal and tax advisors to assess the legal consequences and tax treatment of the proposed product or service. His Private Banker is also at his disposal to provide him with further information, to determine with him whether he is eligible for the product or service envisaged, which may be subject to conditions, and whether it meets his needs. Consequently, Société Générale Private Banking France cannot be held responsible for any decision taken by an investor based solely on the information contained in this document.

This document is confidential, intended exclusively for the person to whom it is given, and may not be communicated or brought to the attention of third parties, nor may it be reproduced in whole or in part, without the prior written consent of Société Générale Private Banking France. For more information, click here.