Transferring and donating art

The content of this article is intended for clients of French nationality whose tax residence is in France.

What are the options for transferring or donating art? What are the legal statuses? And what are the questions and details to be taken into consideration? Laurent Issaurat, our Private Bank’s Head of Art Banking Services, took these questions to Marceau Clermon, who is Notary-in-Partnership at Fidnot.

Laurent Issaurat: You deal with a number of art collectors and owners. In some instances, holding art is well documented. But this is not always the case. What would be your advice?

Marceau Clermon: Many owners of collectibles think that possession alone gives legal title and the protection that goes with it. The reality is far more complex. Paradoxically, while they may have the essential documentation attesting to an item’s authenticity, and which is used for its valuation, they often have no proof of ownership. Since statements made in an estate, donations or distributions do not constitute title(1), beneficiaries may claim ownership of works of art by taking action to establish title, which is made easier when the possessor has no documented evidence. Our advice would be, at the very least, to obtain statements of ownership from all parties, official reports from the bailiff, or to declare these statements in registered deeds.

Laurent Issaurat: Are works of art in the same category as other moveable goods?

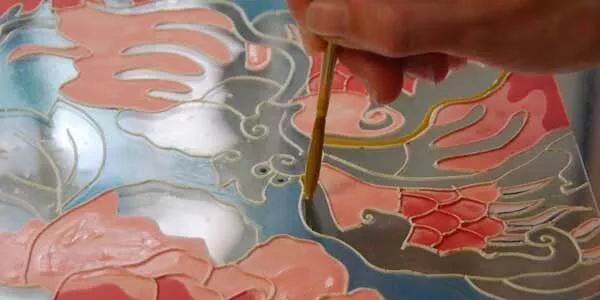

Marceau Clermon: This is where we need to be careful. As counter-intuitive as it seems, works of art and collectibles are not always classified as “moveable goods”. Some works may form part of a building - built-in sculptures and mosaics, like the INVADER tiles decorating the walls of numerous capitals, come to mind. In the French Civil Code, there is some overlap in the categories of the “furnishing” moveable goods ("meubles meublants") that embellish our homes: not all works of art are included in this category; and not all moveable goods are works of art. Article 534 of the French Civil Code expressly excludes “collections of pictures which may be in galleries or private rooms” from the "furnishing" moveable goods category. Barring this exclusion, works of art can legally fall in this category, irrespective their value. These overlaps can result in competing interests. Case in point: the surviving spouse of an estate very often has right of use of this particular kind of moveable object, i.e. works of art, and can also enjoy “usufruct” (life use) or ownership rights. The object(s) therefore cannot be transferred without the spouse’s approval.

Laurent Issaurat: How can I transfer art to my children or grandchildren? Is it possible to legally separate the attributes of ownership by distinguishing bare ownership from right of use?

Marceau Clermon: That is the right strategy. It is possible to donate ownership or bare ownership under the usual legal and fiscal conditions. This ensures an indisputable title of property so that if the work is sold at a later stage it will meet the conditions for a capital gains tax exemption for the duration of the holding period. A very common practice in France today is "donation-partage". Under this device, donors in their lifetime can also distribute their estate down the generations for the purpose of reincorporation ("donation-partage trans-générationnelle-réincorporative"). This means that after 15 years of registering the donation, the works of art will “roll” from the initial donor’s children, to their children’s children, thereby keeping the assets in the family and reducing the tax cost to partition duties of 2.5%.

Laurent Issaurat: What are the benefits of "donation-partage" over gifts from hand to hand or traditional gifts? You would think these easy ways of passing down art.

Marceau Clermon: From a legal and fiscal standpoint, traditional gifts(2) have the disadvantage of being hard to trace. No proof means no rights if there is an objection. It is the cause of many family disputes: again, possession alone does not demonstrate ownership. Gifts from hand to hand(3) are generally recognised for tax purposes. But this in itself does not prove the reality of the donation, given that the declaration is made only by the receiver of the gift. We therefore recommend obtaining documentation from the donor stating that the gift is not a loan but a donation, thus ruling out any grounds for dispute. A notarial deed is invaluable in this respect: it expresses the intention of making a gift and gives an exact description of the object. Where there are many inheritors, "donation-partage" also offers the security of not having to “rebalance” the value of assets upon the death of the donor. A sound precaution given how volatile the value of art can be.

Laurent Issaurat: Could transferring art to a company be another option?

Marceau Clermon: Doing so used to be a tax constraint, as privately-held works of art were exempted from wealth tax while company shares holding art were not. For collectors, placing works of art in a company opens up new opportunities in terms of holding and transferring art. It is also a worthy pursuit for living artists who want to organise their estate and even benefit from the advantages of the Dutreil Lawfor transferring businesses. Today some collectors set up structures of varying sophistication, coupled with a management trust so as to ringfence or “give sanctuary to” a collection. This provides almost as much security as the Anglo-Saxon trusts used by international collectors, with the proviso that “transfer trusts” are not permitted under French law which, naturally, presents a major hurdle.

Laurent Issaurat: How are art assets valued during a succession?

Marceau Clermon: The market value of the asset must be used. It can be determined by the prices seen at auction sales in the two years following death, by estimates made by an auctioneer as part of a notarised inventory, or by the individual value of objects as established in insurance policies. While works of art can be counted as "furnishing moveable goods", the insurance flat-rate option for moveable goods should not lead to confusion: it is not a means of optimisation. The French tax code does allow the submission of contrary evidence to tax authorities. But while it can be demonstrated that a masterpiece painting is legally part of the furniture and furnishings of a home, the use of the flat rate should be avoided if, from a tax perspective, the moveable assets are worth more than 5% of the total estate value.

Interested to know more? Your private banking advisor can assess your situation and propose a tailormade solution.

(1) Such documentation can, however, constitute prima facie evidence as well as presumption of lawful possession.

(2) A traditional gift falls under social or family custom which justifies the giving of gifts for an event or occasion: weddings, births, christenings and first religious sacraments, the donee’s name day or birthday, wedding anniversary, regular family gatherings, Christmas, passing an exam or an entrance exam, etc. It must be of a reasonable value, i.e. proportionate to the donor’s financial situation. Given its modest value, it is not taxable.

(3) A gift from hand to hand is a donation inter vivos of tangible personal property. The declaration of gifts from hand to hand is compulsory.

The content provided on this page is for informational purposes only and is not contractually binding. It is not intended to provide investment advice or any other investment service and does not constitute a personal recommendation, advice, or an offer from Societe Generale Private Banking to purchase, sell or subscribe to investment services and/or financial products.

The information presented above shall not be considered legal, tax or accounting advice. The materials contained therein are for illustrative purposes only and designed to provide the reader with information that may be of use in making decisions. Under no circumstances should it be construed as a personalised recommendation. Readers should consider it neither as an investment recommendation, nor legal, accounting, or tax advice. All wealth management strategies under consideration will need to be approved by your usual legal and tax advisers before implementation.

This document is prepared using sources that Societe Generale Private Banking considers to be reliable and accurate at the time of its creation. Any and all information contained in this document may be amended without prior notice. In no event shall any Societe Generale Private Banking entity be held liable for any decision made by an investor on the basis of this information.

The contents of this page may not be reproduced, in whole or in part, without Societe Generale Private Banking's prior written consent. This document may not be disseminated in the US or to a US resident in any form whatsoever.

Before subscribing to any investment service or financial product, potential investors must read all of the information contained in the detailed documentation on the service or product being considered (prospectus, regulations, "Key Investor Information Document", Term Sheet, and contractual terms of the investment service), paying particular attention to that concerning the risks associated with the service or product.