European sustainable finance: what do you need to know at this stage?

On April 22, 2021, on the occasion of International Earth Day, the United States organized an international climate summit that was described as decisive, with over 40 states present and major commitments made. In this field, Europe is a leader with its "Green Deal" or European Green Pact, unveiled in December 2019. As part of this Green Pact, the Commission announced on 14 July that it had adopted a series of "proposals aimed at adapting the EU's climate and energy policies, transport and taxation with a view to from reduce net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels(1)". Previously, European regulations have been adopted to reinforce the transparency of financial products with regard to the inclusion of environmental and social criteria. Diana Paola Triana Cadena, Head of ESG (Environment, Social, Governance) risk monitoring at SG29 Haussmann, the portfolio management company dedicated to Societe Generale Private Banking in France, tells us more...

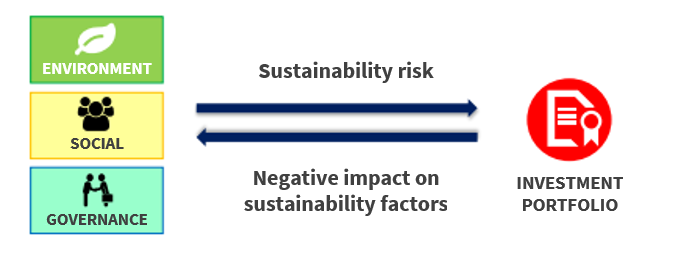

Claire Douchy: Before we look at how Europe is articulating these texts, let's first look at the two important notions they define: "sustainability risks" and "negative impacts on sustainability"...

Diana Paola Triana Cadena: Sustainability risk is defined as an environmental, social or governance event or condition that, if it occurs, could have a material adverse effect on the value of the investment. Sustainability factors include: in the environmental area, greenhouse gas ("GHG") emissions, biodiversity, water, waste; in the social and governance area, international companies' consideration of the United Nations Global Compact(2), the gender pay gap, diversity in governance bodies and exposure to controversial weapons(3) Sustainability risks can have a significant negative impact, potential or actual, on the value of an investment. Conversely, an investment decision can have a negative impact on sustainability.

Claire Douchy: This set of European regulatory measures is one of the most ambitious projects in the world to encourage players in the financial value chain to integrate sustainability and climate change considerations into their activities. What does it cover specifically?

Diana Paola Triana Cadena: It includes four major regulations that must be implemented between March 2021 and mid 2022: the first text to be implemented on March 10 is the SFDR "Sustainable Finance Disclosure Regulation"(4) on non-financial information provided by financial actors. The other three cover firstly the taxonomy regulation, which is a classification tool to consider whether an economic activity is "green" or "sustainable", then the "benchmark" regulation which created financial indices in line with the climate transition or in line with the alignment with the Paris agreements(5) and finally the regulation on the knowledge of customers' preferences with regard to sustainable investments to enable them to invest in savings products in line with their objectives.

Claire Douchy: Can you tell us more about the Sustainable Finance Disclosure Regulation (SFDR), which aims to promote the transparency of sustainable financial products distributed in Europe?

Diana Paola Triana Cadena:This regulation introduced new obligations and common reporting standards for asset management companies and financial advisors. These financial actors are now required to present on their website how they integrate sustainability risks into their investment or product selection processes and how they manage the negative impacts of the selected investments and products on sustainability (greenhouse gases, poor waste management by companies, etc.). In this context, as a financial player concerned by this regulation we have also updated our marketing and pre-contractual information documents for our clients.

Claire Douchy: Can you give us an example of how SG 29 Haussmann integrates sustainability risk management?

Diana Paola Triana Cadena: Let's take the emblematic example of Volkswagen and the "Diesel Gate" scandal. When it was revealed, the Volkswagen group saw its ESG controversy rating rise to Red, i.e. "very severe"(6), as the scandal revealed a serious governance flaw. At the same time, the company's share price fell sharply. For Société Générale Private Banking and its affiliated management companies (SG29 Haussmann and SGPWM-Société Générale Private Wealth Management), this level of Red controversy is a cause for immediate exclusion from portfolios and, more generally, from the universe of securities in which to invest. Of course, this exclusion is not definitive, and the company may be reinstated in the universe of stocks on which managers and advisors can take positions once its level of controversy has been positively reviewed. Other examples can be found in the environmental field: a company in the chemical sector, for example, that has poor waste management, is exposed to very severe controversies because if the risk occurs, it will have a strong impact on the share price. Excluding companies with the most severe ESG controversies from the investment universe is one way in which we integrate sustainability risk.

Claire Douchy: Do you have an example of a negative impact on the sustainability factors of your investment policy?

Diana Paola Triana Cadena: Yes, for example, in the area of global warming and CO2 emissions. We look closely at the level of direct and indirect CO2 emissions of the companies in the portfolios we manage. Not all companies in the same sector emit the same amount of greenhouse gases. My role as risk controller is to check that the aggregate emissions at the portfolio level are lower than those of the portfolio's benchmark index, provided, of course, that this corresponds to the management objective; this is the case for all our portfolios that have the SRI (socially responsible investment) label. It is our responsibility to ensure that our management choices have the least harmful effects on the climate.

(1)https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_fr

(2) The United Nations Global Compact asks companies to align their strategies and operations with ten universal principles related to human rights, labour, the environment and anti-corruption.

(3) Controversial weapons include various types of weapons prohibited by international conventions or European Union regulations, such as certain cluster munitions, anti-personnel mines, biological or toxin weapons, chemical weapons and depleted uranium mines.

(4) SFDR: Sustainable Finance Disclosure Regulation.

(5) The Paris Climate Agreement: at COP21, 195 states signed the Paris Agreement to keep the global temperature increase to 1.5°C by 2100 "compared to pre-industrial levels" and to achieve carbon neutrality by 2050.

(6) Controversy scale: Red=existence of a recent or ongoing very severe ESG dispute (or controversy), Orange=existence of one or more recent or ongoing severe ESG disputes, Yellow=existence of a reportable ESG dispute, Green = few or no ESG disputes.

Would you like to discuss this subject further with us?

GENERAL WARNING:

Societe Generale Private Banking is the business line of the Societe Generale Group operating through its headquarters within Societe Generale S.A. and through departments, branches or subsidiaries, located in the territories mentioned below, acting under the brand names "Societe Generale Private Banking" and "Kleinwort Hambros" and distributing the present document

This document, of an advertising nature, has no contractual value. Its content is not intended to provide an investment service, it does not constitute investment advice or a personalised recommendation on a financial product, nor does it constitute insurance advice or a personalised recommendation, nor does it constitute a solicitation of any kind, nor does it constitute legal, accounting or tax advice from any entity under the authority of Société Générale Private Banking.

The information contained herein is provided for information purposes only, is subject to change without notice, and is intended to provide information that may be useful in making a decision. Past performance information that may be reproduced is not a guarantee of future performance.

The price and value of investments and the income derived from them may go down as well as up. Changes in inflation, interest rates and exchange rates may adversely affect the value, price and income of investments denominated in a currency other than that of the investor. Any simulations and examples contained in this publication are provided for illustrative purposes only. This information is subject to change as a result of market fluctuations, and the information and opinions contained in this publication may change. No Societe Generale Private Banking entity undertakes to update or amend this publication, which may become obsolete after consultation, and will not assume any responsibility in this respect.

The offers related to wealth and financial activities and information mentioned in this document depend on the personal situation of each client, on the legislation applicable to him and on his tax residence. It is the responsibility of the potential investor to ensure that he or she complies with the legal and regulatory requirements of the relevant jurisdiction, in consultation with his or her legal and tax advisors. This publication is not intended for distribution in the United States, to any US tax resident, or to any person or jurisdiction where such distribution would be restricted or illegal.

The offers related to the activities and the wealth and financial information presented may not be adapted or authorised within all Société Générale Private Banking entities. In addition, access to some of these offers is subject to conditions of eligibility.

Certain offers related to the above-mentioned activities and financial information may present various risks, imply a potential loss of the entire amount invested or even an unlimited potential loss, and therefore be reserved for a certain category of investors only, and/or be suitable only for informed investors who are eligible for these types of solutions.

Consequently, before subscribing to any investment service, financial product or insurance product, depending on the case and the applicable legislation, the potential investor will be questioned by his private banker within the Societe Generale Private Banking entity of which he is a client on his knowledge, his experience in investment matters, as well as on his financial situation including his capacity to bear losses, and his investment objectives, including his risk tolerance, in order to determine with him whether he is eligible to subscribe to the financial product(s) and/or investment service(s) envisaged and whether the product(s) or investment service(s) is/are compatible with his investment profile.

The potential investor should also (i) take note of all the information contained in the detailed documentation of the service or product envisaged (prospectus, regulations, articles of association, document entitled "key information for the investor", term sheet, information notice, contractual terms and conditions, etc.), in particular those relating to the associated risks; and (ii) consult his legal and tax advisors to assess the legal consequences and tax treatment of the product or service being considered. His or her private banker will also be available to provide further information, to determine with him or her whether he or she is eligible for the product or service under consideration, which may be subject to conditions, and whether it meets his or her needs.

Accordingly, no entity within Société Générale Private Banking can be held responsible for any decision made by an investor solely on the basis of the information contained in this document.

This document is confidential, intended exclusively for the person consulting it, and may not be communicated or brought to the attention of third parties, nor may it be reproduced in whole or in part, without the prior written consent of the Société Générale Private Banking entity concerned.

Societe Generale Group maintains an effective administrative organisation that takes all necessary measures to identify, control and manage conflicts of interest. To this end, Societe Generale Private Banking entities have put in place a conflict of interest management policy to manage and prevent conflicts of interest. For more details, Société Générale Private Banking clients can refer to the Conflict of Interest Policy available on request from their private banker.

Société Générale Private Banking has also put in place a policy d he processing of claimsmade pa available on request from their private banker or on the Société Générale Private Banking website.

SPECIFIC WARNINGS BY JURISDICTION

France : Unless expressly stated otherwise, this document is published and distributed by Societe Generale, a French bank authorised and supervised by the Autorité de Contrôle Prudentiel et de Résolution, located at 4, place de Budapest, CS 92459, 75436 Paris Cedex 09, under the prudential supervision of the European Central Bank ("ECB") and registered with the ORIAS as an insurance intermediary under the number 07 022 493 orias.fr Societe Generale is a French public limited company with a capital of EUR 1 066 714 367,50 as at 1 August 2019, whose registered office is located at 29, boulevard Haussmann, 75009 Paris, and whose unique identification number is 552 120 222 R.C.S. Paris. Further details are available on request or at www.privatebanking.societegenerale.com.

Luxembourg : This document is distributed in Luxembourg by Société Générale Luxembourg, a public limited company (société anonyme) registered with the Luxembourg Trade and Companies Registry under number B 6061 and a credit institution authorised and regulated by the Luxembourg Financial Sector Supervisory Commission ("CSSF"), under the prudential supervision of the European Central Bank ("ECB"), whose registered office is located at 11, avenue Emile Reuter - L 2420 Luxembourg Further details are available on request or at www.societegenerale.lu. No investment decision of any kind should be made on the basis of this document alone. Société Générale Luxembourg accepts no responsibility for the accuracy or otherwise of the information contained in this document. Societe Generale Luxembourg accepts no responsibility for any actions taken by the recipient of this document solely on the basis of this document, and Societe Generale Luxembourg does not represent itself as providing any advice, in particular with respect to investment services. The opinions, views and forecasts expressed in this document (including its annexes) reflect the personal opinions of the author(s) and do not reflect the opinions of any other person or of Société Générale Luxembourg, unless otherwise indicated. This document has been prepared by Societe Generale. The CSSF has not carried out any analysis, verification or control on the content of this document.

Monaco: This document is distributed in Monaco by Société Générale Private Banking (Monaco) S.A.M., located at 11 avenue de Grande Bretagne, 98000 Monaco, Principality of Monaco, regulated by the Autorité de Contrôle Prudentiel et de Résolution and the Commission de Contrôle des Activités Financières. Financial products marketed in Monaco may be reserved for qualified investors in accordance with the provisions of Law n° 1.339 of 07/09/2007 and Sovereign Order n° 1. 285 of 10/09/2007. Further details are available on request or at www.privatebanking.societegenerale.com.

Switzerland : This document is distributed in Switzerland by SOCIETE GENERALE Private Banking (Suisse) SA ("SGPBS"), whose registered office is at rue du Rhône 8, CH-1204 Geneva. SGPBS is a bank authorised by the Swiss Financial Market Supervisory Authority ("FINMA"). Collective investments and structured products may only be offered in accordance with the Swiss Federal Act on Collective Investment Schemes (Collective Investment Schemes Act, CISA) of 23 June 2006 and the Guidelines of the Swiss Bankers Association (SBA) on Information for Investors in Structured Products. Further details are available on request from SGPBS or at www.privatebanking.societegenerale.com.

This document is distributed by the following entities of the Kleinwort Hambros Group under the name Kleinwort Hambros:

United Kingdom: SG Kleinwort Hambros Bank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. The company's registration number is 119250, it is registered in England and Wales under number 964058 and its registered office is at 5th Floor, 8 St. James's Square, London SW1Y 4JU. If you no longer wish to receive this document, please contact your private banker or contact us at +44 (0) 207 597 3000. Telephone calls may be recorded or monitored.

Jersey and Guernsey : SG Kleinwort Hambros Bank (CI) Limited is regulated by the Jersey Financial Services Commission ("JFSC") for banking, investment, money services and fund services activities. The company is incorporated in Jersey under number 2693, and its registered office is at PO Box 78, SG Hambros House, 18 Esplanade, St Helier, Jersey JE4 8PR. SG Kleinwort Hambros Bank (CI) Limited - Guernsey Branch is also regulated by the Guernsey Financial Services Commission ("GFSC") for banking, investment and money services. Its address is PO Box 6, Hambros House, St Julian's Avenue, St Peter Port, Guernsey, GY1 3AE. The Company (including the branch) is also authorised and regulated by the UK Financial Conduct Authority ("FCA") in respect of regulated mortgage transactions in the UK. The company (including the branch) is not authorised or regulated by the UK Financial Conduct Authority to accept UK bank deposits and is not authorised to hold deposits in the UK. The company's reference number is 310344. This document has not been authorized or reviewed by the JFSC, GFSC or FCA.

Gibraltar : SG Kleinwort Hambros Bank (Gibraltar) Limited is authorised and regulated by the Gibraltar Financial Services Commission for its banking, investment and insurance mediation activities. The company is registered in Gibraltar under number 01294 and its registered office is at Hambros House, 32 Line Wall Road, Gibraltar.

Kleinwort Hambros is part of the Societe Generale Private Banking business line dedicated to private banking of the Societe Generale Group. Societe Generale is a French bank authorised in France by the Autorité de Contrôle Prudentiel et de Résolution, located at 4, place de Budapest, CS 92459, 75436 Paris Cedex 09, under the prudential supervision of the European Central Bank ("ECB") It is also authorised by the Prudential Regulation Authority and supervised by the Financial Conduct Authority and the Prudential Regulation Authority. Further information on SGPB Hambros Group, including additional legal and regulatory information, is available at www.kleinworthambros.com.