How to take into account climate issues in your investments?

The climate issue has been one of the most talked about topics in recent months, and the health crisis we are experiencing has made the sustainability of our production and consumption patterns even more critical. While governments have led the way in this transition, companies and investors also play an important role.

Greenhouse gases(3) (GHG) play an essential role in climate regulation. Without them, the average temperature on Earth would be -18°C instead of +15°C (see diagram below). However, since the 19th century, human activity has significantly increased the amount of GHG in the atmosphere. This has resulted in a change in the natural climatic balance that is reflected in a general warming of the earth's surface and the oceans. The global average temperature has increased by 1.2°C since the pre-industrial period (1850-1900) according to the World Meteorological Organization(4).

The effects of this warming can be seen all over the planet: fires, periods of drought, extreme weather events, etc. Scientists have long since highlighted the risks to our social and economic equilibrium and the urgent need to promote an economy that emits less GHG. Economic agents are therefore exposed to physical risks, but also transition risks (changes in regulations, impact on the valuation of assets, etc.) that are important to take into account when talking about investments.

Claire Douchy: Petra, as a portfolio manager, how do you integrate these issues?

Petra Besson Fencikova: While governments are making commitments in the fight against climate change, through the signing of agreements such as the COP (Conference of the Parties), businesses play an essential role. To achieve the objectives of the Paris Agreement(5), all economic sectors must begin to change, starting with the sectors that account for 90% of global GHG emissions: energy, industry and transport(6). These adaptations to decarbonize industrial processes, transportation and agriculture require massive investments. There are therefore many opportunities for investors. I am thinking, for example, of companies that are developing energy efficiency technologies or that are positioned in the energy renovation of buildings, with the use of efficient systems to produce heat and limit energy consumption. Companies involved in the renewable energy value chain also benefit from new investment flows, as the share of these energies should significantly increase in the energy mix. The food sector, too, which must meet the challenge of feeding the world's population while preserving the climate and biodiversity, also offers investment opportunities. For example, with the development of new sources of sustainable nutrition such as meat protein substitutes, or the optimization of farms through digital technology. Finally, waste management contributes to climate change mitigation. Companies specializing in this activity are implementing breakthrough innovations in recycling and promoting the circular economy.

Claire Douchy: On the renewable energy sector more specifically, what is your opinion as manager Edouard?

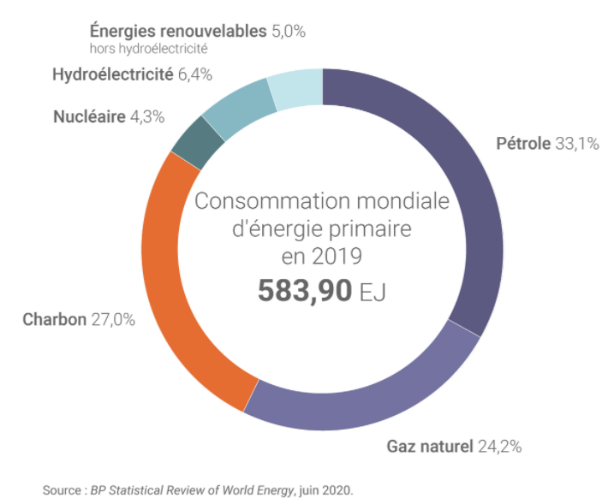

Edouard Bouteau: This is a sector that holds a lot of opportunities because it is growing rapidly: the demand for electricity will continue to increase strongly because it allows the use of fossil fuels to be replaced in many areas; but this electricity must be created from decarbonized sources. To reach the Paris Agreement target, global GHG emissions must fall by 25% by 2030 and 65% by 2050 compared to current levels(7), this is considerable and a source of growth and innovation: renewable and hydroelectric energy are one of the solutions. In 2019, they represented 11% of the world's primary energy consumption, as shown in the graph below.

According to the International Energy Agency(8) , to reach a sustainable scenario compatible with the Paris Agreement, this rate would have to rise to 35%, which is a considerable annual growth in this sector. In terms of innovations, I am thinking of hydrogen or renewable natural gas, but also of companies that are developing electricity storage or energy efficiency solutions.

Claire Douchy: Petra, what do you say to those who would like to integrate climate issues at the heart of their investments and do not know where to start?

Petra Besson Fencikova: I tell them that climate issues are already taken into account in multi-sector responsible investment solutions that cover all economic sectors. of the company and its products, the management of natural capital, the opportunities for developing environmental solutions or even waste management. And then, if they wish, I would invite them to study the more specialized funds on strategies specifically oriented towards the climate, with the awareness that these strategies do not cover all economic sectors, but only those that provide real solutions to the fight against or the adaptation to climate change.ons, I am thinking of hydrogen or renewable natural gas, but also of companies that are developing electricity storage or energy efficiency solutions.

Your Private Banker is at your disposal to learn more about the sustainable investment solutions offered by Société Générale Private Banking.

(1) SGPWM is a public limited company (société anonyme) under Luxembourg law, registered in the Luxembourg Trade and Companies Register under number B 60.963, having its registered office at 11 Avenue Emile Reuter, L- 2420 Luxembourg, Grand Duchy of Luxembourg and having VAT number LU23479311.(https://sgpwm.societegenerale.com/fr/tools/informations-legales/)

(2) Approved by the AMF in 2006, SG 29 Haussmann, a subsidiary of Société Générale, is the asset management company dedicated to the management of private client assets. SG 29 Haussmann manages over 7.9 billion assets as of December 31, 2020. The management team is composed of around 20 experienced managers. It relies on the global network of Societe Generale Private Banking, composed of 350 investment professionals located around the world. (https://sg29haussmann.societegenerale.fr/fr/informations-legales/)

(3) See the site notre environnement.gouv.fr

(4) Climate change in 2020: increasingly alarming indicators and effects, April 19, 2021 : public.wmo.int/fr/medias/communiqu%C3%A9s-de-presse/changement-climatique-en-2020-des-indicateurs-et-des-effets-de-plus-en.

(5) The Paris Agreement is a legally binding international treaty on climate change. It was adopted by 196 Parties at COP 21 in Paris on December 12, 2015 and entered into force on November 4, 2016.- https://unfccc.int/fr/processus-et-reunions/l-accord-de-paris/l-accord-de-paris#:~:text=L'accord de Paris est,contraignant sur les changements climatiques.&text=Son objectif est de limiter,par rapport au niveau préindustriel

(7) According to the European Union's Global Energy and Climate Outlook 2018.

(8) Source: www.iea.org/reports/key-world-energy-statistics-2021/outlook

Would you like to discuss this subject further with us?

GENERAL WARNING:

Societe Generale Private Banking is the business line of the Societe Generale Group operating through its headquarters within Societe Generale S.A. and through departments, branches or subsidiaries, located in the territories mentioned below, acting under the brand name "Societe Generale Private Banking" and distributing the present document.

This document is an advertisement and has no contractual value. Its content is not intended to provide an investment service, nor does it constitute investment advice or a personalized recommendation on a financial product, nor insurance advice or a personalized recommendation, nor a solicitation of any kind, nor legal, accounting or tax advice from any entity under the responsibility of Société Générale Private Banking.

The information contained herein is provided for information purposes only, is subject to change without notice, and is intended to provide information that may be useful in making a decision. The information on past performance that may be reproduced does not guarantee future performance.

The private bankers of Société Générale Private Banking entities are available to provide potential investors with further information on the variations of the themes presented in this document within the Société Générale Private Banking entity concerned.

This document is confidential, intended exclusively for the person consulting it, and may not be communicated or brought to the attention of third parties, nor may it be reproduced in whole or in part, without the prior written consent of the Société Générale Private Banking entity concerned.

No Société Générale Private Banking entity can be held responsible for any decision made by an investor based solely on the information contained in this document.

Societe Generale Group maintains an effective administrative organization that takes all necessary measures to identify, control and manage conflicts of interest. To this end, Societe Generale Private Banking entities have put in place a conflict of interest management policy to manage and prevent conflicts of interest. For more details, Société Générale Private Banking clients can refer to the Conflict of Interest Policy available on request from their private banker.

S ociétéGénéralePrivate Banking has also implementedapolicyof d heprocessing ofclaimsmade pa availableonrequestfrom their private banker or on the Société Générale Private Banking website.

SPECIFIC WARNINGS BY JURISDICTION

France: Unless expressly stated otherwise, this document is published and distributed by Société Générale, a French bank authorized and supervised by the Autorité de Contrôle Prudentiel et de Résolution, located at 4, place de Budapest, CS 92459, 75436 Paris Cedex 09, under the prudential supervision of the European Central Bank ("ECB") and registered with the ORIAS as an insurance intermediary under the number 07 022 493 orias.fr Societe Generale is a French société anonyme with a capital of 1 046 405 540 euros as of February 1, 2022, whose registered office is located at 29, boulevard Haussmann, 75009 Paris, and whose unique identification number is 552 120 222 R.C.S. Paris. Further details are available on request or at www.privatebanking.societegenerale.com.

Luxembourg: This document is distributed in Luxembourg by Société Générale Luxembourg, a public limited company (société anonyme) registered with the Luxembourg Trade and Companies Registry under number B 6061 and a credit institution authorized and regulated by the Luxembourg Financial Sector Supervisory Commission ("CSSF"), under the prudential supervision of the European Central Bank ("ECB"), and whose registered office is located at 11, avenue Emile Reuter - L 2420 Luxembourg. Further details are available on request or at www.societegenerale.lu. No investment decision of any kind should be made on the basis of this document alone. Société Générale Luxembourg accepts no responsibility for the accuracy or otherwise of the information contained in this document. Societe Generale Luxembourg accepts no responsibility for any actions taken by the recipient of this document solely on the basis of this document, and Societe Generale Luxembourg does not represent itself as providing any advice, in particular with respect to investment services. The opinions, views and forecasts expressed in this document (including its annexes) reflect the personal opinions of the author(s) and do not reflect the opinions of any other person or of Société Générale Luxembourg, unless otherwise indicated. This document has been prepared by Société Générale. The CSSF has not carried out any analysis, verification or control on the content of this document.

Monaco: This document is distributed in Monaco by Société Générale Private Banking (Monaco) S.A.M., located at 11 avenue de Grande Bretagne, 98000 Monaco, Principality of Monaco, regulated by the Autorité de Contrôle Prudentiel et de Résolution and the Commission de Contrôle des Activités Financières. Financial products marketed in Monaco may be reserved for qualified investors in accordance with the provisions of Law n° 1.339 of 07/09/2007 and Sovereign Order n° 1. 285 of 10/09/2007. Further details are available on request or at www.privatebanking.societegenerale.com.

Switzerland: This document is distributed in Switzerland by SOCIETE GENERALE Private Banking (Suisse) SA ("SGPBS"), headquartered at rue du Rhône 8, CH-1204 Geneva, Switzerland. SGPBS is a bank authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). Collective investments and structured products may only be offered in accordance with the Swiss Federal Act on Collective Investment Schemes (Collective Investment Schemes Act, CISA) of June 23, 2006, and the Guidelines of the Swiss Bankers Association (SBA) on Information for Investors in Structured Products. Further details are available on request from SGPBS or at www.privatebanking.societegenerale.com.

This document is not distributed by the entities of the Kleinwort Hambros Group that operate under the brand name "Kleinwort Hambros" in the United Kingdom (SG Kleinwort Hambros Bank Limited), Jersey and Guernsey (SG Kleinwort Hambros Bank (CI) Limited) and Gibraltar (SG Kleinwort Hambros Bank (Gibraltar) Limited) Consequently, the information communicated and any offers, activities and financial information presented do not concern these entities and may not be authorized by these entities or adapted in these territories. Further information on the activities of Societe Generale's private banking entities located in the United Kingdom, Channel Islands and Gibraltar, including additional legal and regulatory information, is available at www.kleinworthambros. com