Behavioural finance

Behavioural finance applies psychology to finance: it differs from classical financial theory by considering that individuals are not purely rational beings, but that they are influenced by their emotions or biased in their thinking. These biases and their impacts were demonstrated through experiments.

By revealing the likely existence of biases in every financial decision, behavioural finance aims to allow each person to make informed financial decisions, while being aware of the factors that might influence them. These factors exist in each one of us, with a varying intensity according to our personality and habits.

There are many instances of behavioural biases in everyday life that can easily be applied to finance: “Between two identical restaurants (same menu, price and décor), one empty the other full, which one would you choose? And what if your best friend advised the first one? The same applies to financial products, one of which is very successful and the other recommended by somebody you trust entirely (family member, friend, …); which one would you choose?”

Another example drawn from research conducted in the field of finance in 1988 by Samuelson & Zeckhauser is the “status quo bias” on wealth allocation decisions. In the case of an inheritance, the initial allocation has a decisive influence even if it does not comply with the heir’s profile and/or interests.

Behavioural biases influence the risk / return ratio which is involved in so many financial decisions:

- by their influence on the perception or acceptance of risk,

- by their impact on the return that is hoped for or required,

- or by the relationship between these two factors that creates a distortion in the choices.

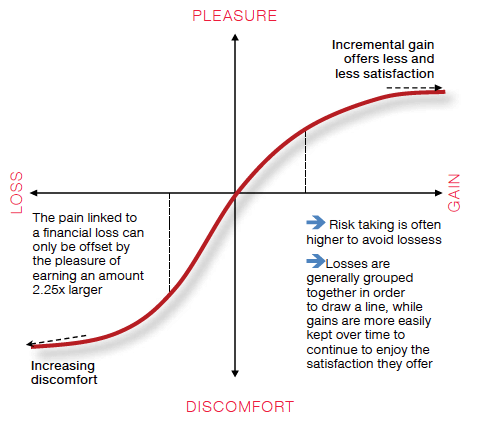

“Prospect theory” demonstrated by A. Tversky and D. Kahneman

Asymmetrical relationship between the pleasure created by a financial gain and the pain of a loss2.

The various behavioural biases

Behavioural finance is such a vast subject that it is not easy to offer a segmentation of the various biases. Any behavioural element can be taken into account: reasoning mistakes, but also individual or collective emotions. Four categories are nevertheless often mentioned :

Cognitive : Forms of reasoning that deviate from logical or rational thinking. “Mental anchoring” for instance is the use of mental references that block reasoning: the seller’s starting price in a negotiation for instance, or the price at which a security is bought (which one will be reluctant to sell at a loss even when the environment has radically changed)..

Emotional : A set of emotions that introduce a bias in the decision process. One could mention the “House money” bias (or “discretionary money”), which refers to the lesser caution and attention paid to the management of a specific aspect of one’s wealth or revenues. Funds from an inheritance or capital gains will not be managed in the same way as a salary for instance.

Decision : Automatic, intuitive and quick mental operations that create bias in decision-making. One of the best-known biases is called “disposition effect” and is defined as the non-linear and opposing perception of gains and losses. This leads an investor to keep assets (stocks, funds, real estate, etc.) that have dropped in value while selling too quickly assets whose price have increased.

Social : The influence of our interactions with others such as herd behaviour, cultural biases or rumours. This also covers the “information cascade” (illustrated by the restaurant example above) in which an individual chooses a course of action based on the actions of others without taking into account his or her own judgement.

Biases can be both negative and positive (“optimism”, “over-confidence”, etc.) like the “attribution bias” which attributes a good performance to one’s own skills and blames external and uncontrolled factors for a disappointing one.

Financial markets offer an excellent opportunity to become aware of one’s own biases, but it is an expensive use of the markets, as George Goodman3 wrote in 1968: “If you don’t know who you are, the stock market is a very expensive place to find out !”

Behavioural finance is a debated subject, which is still struggling to demonstrate its contribution in terms of individual performance. It offers nevertheless the possibility, if a person is aware of his or her own biases, to erect safeguards before making financial decisions.

(1) Source: “Status Quo Bias in Decision Marking”, William Samuelson (Boston University) & Richard Zeckhauser (Harvard university); published in the Journal of Risk and Uncertainty; March 1988, Volume 1. - (2) Source: « Advances in Prospect Theory: Cumulative Representation of Uncertainty”, Amos Tversky (Stanford University) & Daniel Kahneman (University of California at Berkeley); published in the Journal of Risk and Uncertainty; 1992, Volume 5 - (3) “The money game” by George J W Goodman (under the pen name ”Adam Smith”) published by Vintage in August 1976.