Art Banking - Ethnographic art

In a world where art transcends both geographic and cultural boundaries, the traditional arts of Africa, Oceania, Southeast Asia and North America stand apart for their unique blend of history, spirituality and aesthetic form. Global interest in what was once called “primitive art” is growing. But what defines objects in this category? How are they valued and how is the market adapting to meet the demands of an increasingly globalised and discerning audience?

To answer these questions, our Head of Art Banking Services, Laurent Issaurat, met with Alexis Maggiar, International Head of African and Oceanic Art, and Vice-Chairman of Christie’s France. Alexis drew on his two decades of expertise to explain what makes these artworks distinctive, outline key market trends and offer essential advice for both new and seasoned collectors. Step into an artistic world steeped in history and emotion.

How would you define ethnographic art?

Alexis Maggiar: There has been much debate over the correct term to use, as exemplified by the decisions made at the Musée du Quai Branly in Paris. Personally, I prefer the term African and Oceanic art, though this is quite a broad label that calls for some clarification. Some specialists make a distinction, for example, between “classical” or “ancient” African art and “contemporary” African art.

But what do we really mean by “ancient”, considering that the objects in my area of expertise date from the twelfth — for certain pieces from Mali — to the early twentieth century? To my mind, two criteria define an artwork as ancient: first, it must have served a ritual or functional purpose; and second, it must not have been created for commercial ends. Only then can an object truly be considered “authentic”.

My department’s area of expertise now extends beyond Africa and Oceania to include art from Southeast Asia and North America.

How are objects in this category valued?

A.M.: I’ve been captivated by African and Oceanic art ever since I did work experience at Christie’s over twenty years ago. Until then, my main interest was twentieth century art; then suddenly, before my eyes, I discovered something I’d never seen before. What struck me first and foremost about these artworks was the quality and diversity of their formal features.

When it comes to value, the most desirable pieces are those that are clearly the work of a skilled artist, whose trace is perceptible; pieces that stand out among similar works. As with all art movements around the world, whatever the region, there are highs and lows – high points after which the style wanes. That’s why, alongside age and authenticity, I consider beauty — subjective though it may be — a fundamental criterion.

At the beginning of the twentieth century, Frans Olbrechts argued that when faced with a piece of ethnographic art, the question to ask was whether it was the work of a master — an artist whose style transcends that of any ethnic group. Some unsigned works are crafted with such skill that they can be attributed to a specific individual, even if their name remains unknown. A famous example is the Kota artist known as the Sebe River Master , whose works include a remarkable piece we sold last October.

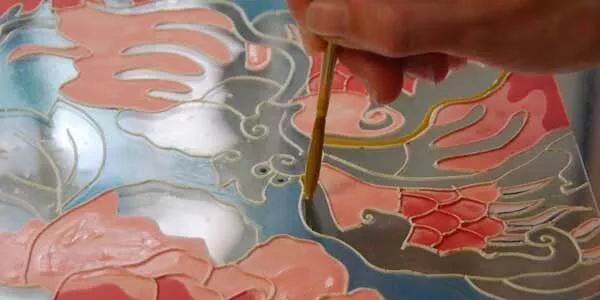

©Christie’s LTD 2025 - Ph : Guillaume Onimus

What are the key “styles” and “regions” in this market?

A.M.: Aside from the growing popularity of Oceanic art, certain market trends are emerging in African art. Nigerian and Cameroonian works, for example — often characterised by thick patinas and an “expressionist” style — are currently less sought after on the international market. That means major pieces from these regions can be acquired at relatively affordable prices. Conversely, West African art continues to attract strong interest from collectors.

There are also certain “stars” of the market, such as the Fang people of Gabon, whose art has long been in demand. We actually set a new record for African art back in March, when we sold an iconic Fang reliquary head from the Barbier-Mueller collection for close to 15 million euros.

The birth of a market

A.M.: The market truly emerged at the beginning of the twentieth century, driven in large part by well-known art dealers in Paris and New York such as Joseph Brummer, Alfred Stieglitz, Charles Ratton and Paul Guillaume. Their role, closely tied to the major avant-garde art movements of the time, makes this a particularly fascinating period. The Surrealists, for example, were fascinated by North American art. Seen as witness objects by the Cubists, provocative objects by the Dadaists, poetic objects by the Surrealists and mythical objects by the Abstract Expressionists, sculptures by African, Oceanic and Native American artists accompanied the cultural revolutions of the first half of the twentieth century. For the members of these movements, these objects symbolised beauty, magic and a challenge to Western norms.

What does a typical collector look like?

A.M.: The profile of collectors has changed significantly, largely because the market has become clearly globalised. Paris remains the historic centre and home of the major auctions in this category, but buyers now come from all over the world, including Australia, Asia, Europe and the Americas.

At Christie’s, we’re seeing an increasing number of first-time buyers of African and Oceanic art who were already clients of our house. They tend to be curious, open-minded, multidisciplinary individuals who do not adhere rigidly to traditional boundaries in the arts. They consider it completely natural to pair a painting with a sculpture, or a design object with a piece of classical art from Africa or Oceania. In fact, it is precisely this dialogue between cultures, periods and disciplines that informs their view of art and their purchasing decisions.

How is the market evolving?

A.M.: Accurately gauging global changes in the market's value is a challenge, largely because of the secrecy surrounding private transactions. However, there is clearly a growing interest in high-quality artworks among collectors and a move away from mid-value works. The same is true of the entire art market, not only our segment. In terms of price, it’s important to stress that in my field, it’s still possible to buy a genuine masterpiece for a few thousand or tens of thousands of euros. I’m thinking for example of a beautiful, intricately incised club from Tonga or a magnificent Tellem statue from Mali with a thick, crusty patina.

At the other end of the scale, some pieces go for several million euros. But regardless of their budget, collectors should see nothing as off-limits. Before buying, they should take time to consider what they like, whether that’s for aesthetic, historical or intellectual reasons.

At Christie’s, we take great pains to present only the highest quality and rarest works.

How can buyers protect themselves from making a big mistake?

A.M.: Taking the time to explore, visit exhibitions, read reference books and talk to specialists is an essential part of the process and helps buyers develop a critical eye. In the current market, I recommend focusing on ancient pieces that are authentic, rare and, above all, well documented. Traceability is crucial, as it enables buyers to understand the history of the object while guaranteeing its value over time.

It’s natural to be cautious when making your first purchase. Look for pieces that have already been exhibited, auctioned or written about, all of which helps establish the work’s standing, and offers extra reassurance to budding collectors.

Alexis Maggiar

Profile of Alexis Maggiar, Vice-Chairman of Christie’s France and International Head of African and Oceanic Art.

He joined Christie’s as International Head of African and Oceanic Art in June 2020, following more than two decades in his field. Fascinated by the dialogue between art and culture, he has propelled sales of ethnographic art in both Paris and New York, and helped rediscover major works.

©Christie’s LTD 2025 - Ph : Studio Shaporo

DISCLAIMER :

This document has no contractual value. It is not intended to provide an investment service such as investment advice, a related investment service, arbitration advice or legal, accounting or tax advice from Société Générale Private Banking France (‘SGPB France’), which cannot therefore be held liable for any decision taken by an investor solely on the basis of its content. SGPB France undertakes neither to update nor to modify it.

Before making any investment decision, please review the details of the documentation for the service or product being considered, including any associated risks, and consult your legal and tax advice. If the document is consulted by a French tax non-resident, he or she will have to ensure with his or her legal and tax advisors that he or she complies with the legal and regulatory provisions of the jurisdiction concerned. It is not intended for distribution in the United States, or to a U.S. tax resident, or to any person or jurisdiction for which such distribution would be restricted or unlawful.

The past performance information that may be reproduced is not intended to guarantee future performance. These future performances are therefore indicative. The return to investors will vary depending on market performance and the shelf life of the investment. Future performance may be subject to tax, which depends on your present and future personal situation.

Societe Generale has put in place a policy to manage conflicts of interest. SGPB France has put in place (i) a policy to handle complaints made by its customers, available on request from your private banker or on its website and (ii) a policy to protect personal data (https://www.privatebanking.societegenerale.com/fr/protection-donnees-personnelles/). At any time and without charge, you have the right to access, rectify, limit processing, erase your data and the right to object to their use for the purposes of commercial prospecting by contacting our Data Protection Officer by email (protectiondesdonnees@societegenerale.fr). In the event of a dispute, you can lodge a complaint with the Commission Nationale de l’Informatique et des Libertés (CNIL), the supervisory authority responsible for compliance with personal data obligations.

This document is issued by Societe Generale, a French bank authorized and supervised by the Prudential Control and Resolution Authority, located at 4 Place de Budapest, 75436 Paris Cedex 09, under the prudential supervision of the European Central Bank (‘ECB’) and registered with ORIAS as an insurance intermediary under number 07 022 493, orias.fr. Societe Generale is a French public limited company with a capital of EUR 1 003 724 927.50 on 17 November 2023, whose registered office is located at 29 boulevard Haussmann, 75009 Paris, and whose unique identification number is 552 120 222 R.C.S. Paris (ADEME FR231725_01YSGB). More details are available on request or at www.privatebanking.societegenerale.com/. This document may not be communicated or reproduced in whole or in part, without the prior written consent of SGPB France.