"Relance" label: supporting the French economy

What is the "Relance" label?

Launched on 19 October 2020 by Bruno Le Maire, Minister of the Economy, Finance and the Recovery, and Alain Griset, Minister Delegate, in charge of SMEs**, as part of France Relance, the "Relance" label aims at recognising investment funds that have committed to rapidly mobilising new resources to support the equity and quasi-equity capital of French companies, and in particular SMEs and MidCaps. It thus enables savers to easily identify investments that can meet the needs of companies, thereby encouraging the mobilisation of savings in favour of the recovery.

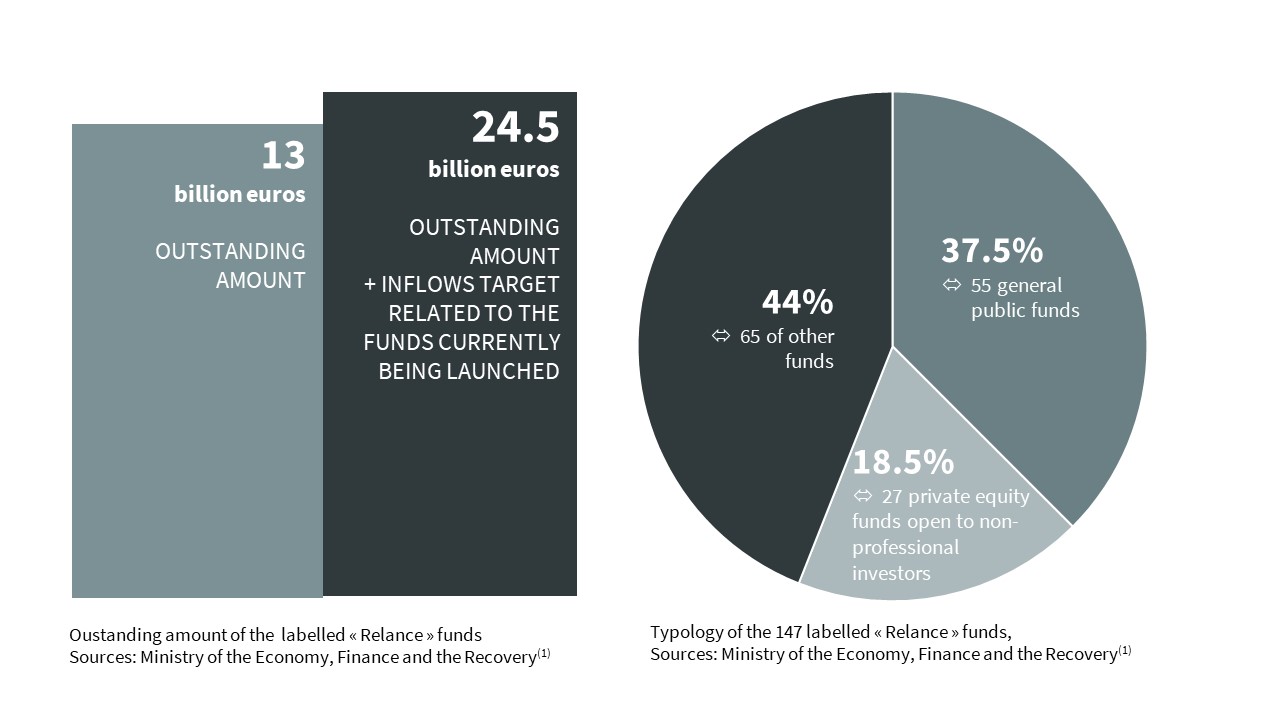

A few figures...

Taking into account the inflows and investment targets of the funds being launched, more than 70% of the funds with the "Relance" label are invested in equity and quasi-equity in French companies and 55% in French SME-ETIs.

Investing in funds with the Relance label thus makes it possible to bring new resources to French companies. All of the funds with the Relance label have participated in nearly 160 capital increases or Initial Public Offerings, including nearly 70 for "general public" funds.(1)

To conclude

All distributors of savings products, particularly banks and insurance companies, have mobilised to make this theme a success. We are pleased to be associated with this movement through our management company SG 29 Haussmann.

*Authorised by the French Financial Markets Authority in 2007, SG 29 Haussmann, a subsidiary of the Societe Generale Group, is the portfolio management company dedicated to managing the assets of Societe Generale Private Banking France’s clients.

** SME = Small and medium-sized enterprises

(1) Press Release, "La mobilisation de l’épargne pour le financement des entreprises franchit une nouvelle étape avec près de 150 fonds labellisés « Relance »", French Ministry of the Economy, Finance and the Recovery, 2 March 2021 - https://minefi.hosting.augure.com/Augure_Minefi/r/ContenuEnLigne/Download?id=E5F980D6-EC13-4E7C-BCCF-8C70A8FA030E&filename=728-%20La%20mobilisation%20de%20l%C3%A9pargne%20pour%20le%20financement%20des%20entreprises%20fr.._.pdf

This document is not intended to be a contract, but for advertising purposes only. Its content is not intended to provide investment advice on the mutual funds presented herein, nor, where applicable, on the products mentioned as eligible for inclusion in their assets, nor any other investment service. The information contained therein is provided for information purposes only. The information on past performance is not a guarantee of future performance. This document is intended exclusively for the person to whom it is addressed and may not be transmitted to third parties, nor reproduced in whole or in part, without the prior written consent of SG 29 Haussmann.

This document has been compiled from sources that SG 29 Haussmann considers to be reliable and accurate at the time of its production. All information in this document is subject to change without notice. SG 29 Haussmann cannot be held liable for any decision taken by an investor on the basis of this information.

The mutual funds presented in this document are funds governed by French law that comply with the UCITS Directive (2009/65/EC) and are authorised by the Autorité des marchés financiers.

Before subscribing to a mutual fund, potential investors should read all the information contained in the detailed fund documentation and more particularly the "Risk Profile" section of the prospectus and the Key Investor Information Document (KID). The prospectus and the KID of the fund are available on request from SG 29 Haussmann.

The KID is also available on the sg29haussmann.societegenerale.fr website and on the AMF website (www.amf-france.org).

Potential investors must also ensure that the fund is compatible with their financial situation, their investment objectives, their knowledge and experience in financial instruments and their ability to withstand losses.

SG 29 Haussmann is a portfolio management company approved by the Autorité des Marchés Financiers, under no. GP 06000029, Société par Actions Simplifiée, with a capital of EUR 2,000,000 registered with the Paris Trade and Companies Registry under the identification number 450 777 008 RCS Paris, the registered office of which is located at 29 Boulevard Haussmann, 75009 Paris. Further details are available on sg29haussmann.societegenerale.fr

Copyright Société Générale Group 2021. All rights reserved.

Key symbols, Société Générale, Societe Generale Private Banking are registered trademarks of Société Générale. All rights reserved.